New Canadian Procedures Are A Win For Holland America Line Guests Cruising To Alaska And Canada

Holland America Line is pleased with the recent announcement of the lifting of Canadian pandemic border restrictions. Under the new guidelines, Canadian border vaccination and testing requirements are no longer necessary, which is an important step for the cruise industry in simplifying the travel process for itineraries to Alaska and Canada.

You May Like: Which Princess Cruise Ship Is The Best For Alaska

How To Buy Carnival Stock With A Brokerage Account

Carnival is a publicly traded company, so its easy to buy through most types of brokerage accounts. If youre of age and you dont yet have a brokerage account, you can open one through a variety of different investment companies and platforms. Before you make a decision on what kind of brokerage account to open, its important to weigh your options. Each broker offers different account minimums and trading commissions, so some accounts will fit your financial situation better than others.

In the grand scheme of the market, CCL stock is fairly reasonably priced. But if youd like to buy a fractional share, you have the option to do so with a brokerage account that supports fractional shares.

Once youve made a decision about what kind of brokerage account to open, you should fund your account and figure out how many shares you want to buy. You can then put in an order to buy shares of CCL. You can buy at market price, or place a limit order that lets you dictate the maximum or minimum price at which youre willing to buy or sell.

| Brokerage Comparison |

Read Also: How Much Does An Alaska Cruise Cost

Carnival Says 2023 Bookings Show Cruisers So Ready To Put Pandemic To Rest

Carnival CEO Josh Weinstein said, during Wednesdays earnings call for its fiscal fourth quarter that ended on November 30, some consumers are a bit weary about booking cruises with Covid and flu cases on the rise. But that didnt dampen his optimism about 2023 with Carnival seeing a surge in bookings for the new year,

Carnival’s still sailing through a financial storm, but investors are just happy it hasn’t sunk.

Also Check: How Are Cruise Ships Built

Tasi Slips For A Second Day In Line With Oil Prices: Closing Bell

RIYADH: Saudi Arabias benchmark index ended lower for a second consecutive day after oil prices fell and inflation and high interest rates triggered a global recession.

Brent crude settled at $101.68 a barrel, while West Texas Intermediate traded at $95.83, as of 3:08 p.m. Saudi time.

As of Wednesdays closing bell, TASI lost 0.15 percent to 12,291 while the parallel market, Nomu, added 0.98 percent to 21,758.

The Saudi National Bank shed 0.28 percent, while the Kingdoms largest valued bank, Al Rajhi, fell 0.91 percent.

Saudi British Bank added 0.72 percent, after its profit increased by 10 percent to SR2.1 billion in the first half of 2022.

Herfy Food Services Co. slipped 4.01 percent, after its half-year profit was down 7 percent to SR49 million.

Telecom giant stc gained 0.40 percent, after posting a slight profit surge of 2 percent to SR5.9 billion in the first half of 2022.

Princess Cruises Readies For Full Japan Season In 2023 Exclusive Princess Medallionclass Service Comes To Japan

Following the recent decision by the Japanese government to allow the return of international cruise ships to the country, Princess Cruises has announced it will begin homeport sailing in Japan starting March 15, 2023, giving guests in the region the opportunity to enjoy the effortless, personalized Princess MedallionClass experience for the first time.

You May Like: Royal Caribbean Countdown To Cruise

Dow Jones Futures Today: Treasury Yields Oil Prices

Ahead of Tuesdays opening bell, Dow Jones futures rose 0.2% vs. fair value, while S& P 500 futures gained 0.3%. Nasdaq 100 futures moved up 0.5% vs. fair value. Remember that overnight action in Dow Jones futures and elsewhere doesnt necessarily translate into actual trading in the next regular stock market session.

The 10-year Treasury yield fell significantly to 3.65% Monday. Last week, the 10-year Treasury yield briefly topped 4%, which hadnt been done for more than decade.

Meanwhile, U.S. oil prices jumped more than 4% Tuesday, as West Texas Intermediate futures traded above $83 a barrel. Last week, they fell to their lowest level of the year. On Wednesday, OPEC+ will meet to consider a production cut in order to help prop up falling oil prices.

Also Check: Are Viking River Cruises Handicap Accessible

Carnival Business Model And Revenue Streams

The companys headquarters are in Miami, Florida, and its CEO is Arnold W. Donald. Carnival Corporation is the worlds largest cruise operator with a fleet of over 100 vessels across nine different cruise line brands. It sells cruises through travel agents and tour operators primarily for the North American, Australian, European, and Asian markets. The company serves tens of millions of passengers annually.

Carnival generates revenue primarily from ticket sales of its portfolio of cruise line brands, namely Carnival Cruise Line, Princess Cruises, Holland America Line, P& O Cruises , Seabourn, Costa Cruises, AIDA Cruises, P& O Cruises , and Cunard.

The company generates about 62% of its total revenue from ticket sales. The remaining 38% is derived from onboard purchases, like beverage sales, internet, casino gaming, spas, shore excursions, specialty restaurants, retail, and photo sales.

Also Check: Repositioning Cruises 2022 From Europe To Us

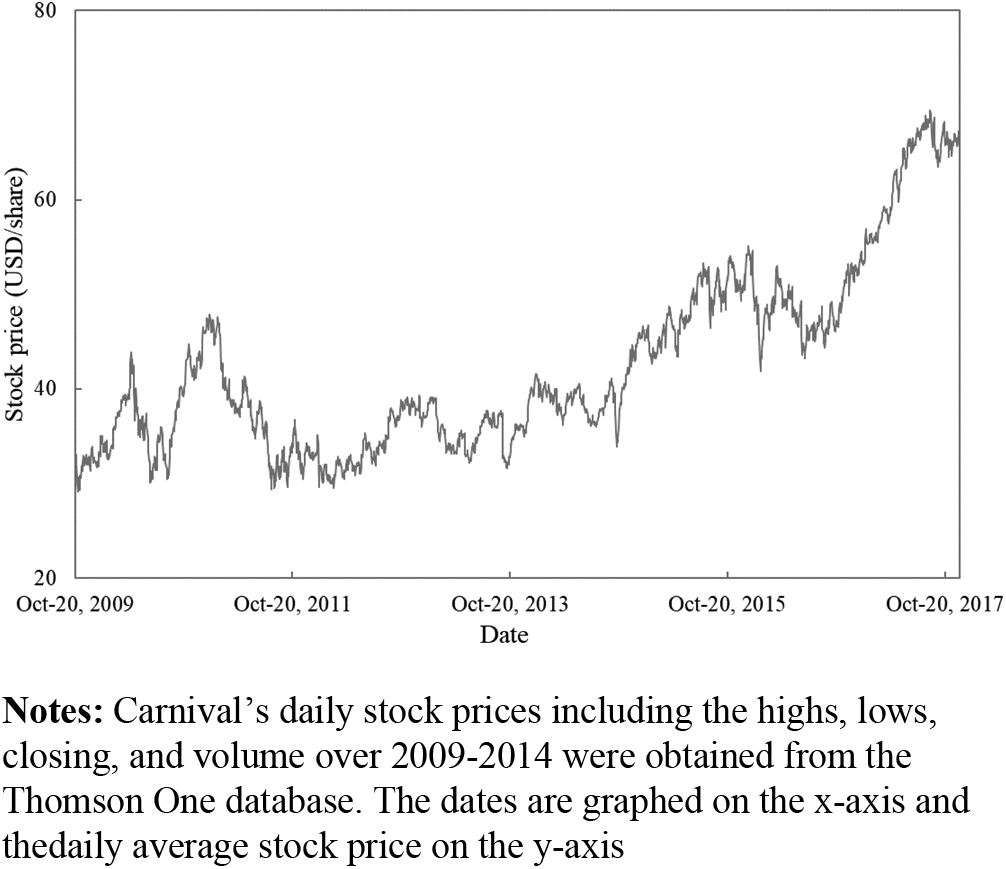

A Closer Look At Ccl Stock

Depending on how ambitious and optimistic we are, its possible to set a couple of different price objectives for CCL stock.

- 7 Cheap Stocks to Buy If You Have $250 to Spend

The most obvious one would be $50, the share price that it had reached in mid-January of 2020. Those were good times, werent they?

At the end of May 2021, it felt like CCL stock would reach that target soon as it hovered near $30.

Then investors started to worry about new Covid-19 variants. As a result, a bull market in Carnivals shares was off the table.

Yesterday CCL stock closed slightly above $23. That, of course, isnt even halfway to the $50 level.

But then, is that necessarily a bad thing? Maybe its an opportunity for investors to add shares now, in the hopes of doubling their money.

Possibly, they could even do better than that. After all, CCL stock was riding high at $70 in early 2018. It might get there again. That wont happen tomorrow or next week, but it will occur eventually.

Read Also: Keeping The Blues Alive Cruise 2022

Cruise Line Stocks Jumped Today

The stock market woke up on the right side of the bed Tuesday, and shares of many companies pushed higher. Among those that gained notably were cruise lines, which have faced a number of headwinds as interest rates rose, fear of recession increased, and high oil prices further boosted their expenses. Shares of Carnival were up as much as 7.3% in early trading, Norwegian Cruise Line Holdings was up by as much as 7.2%, and Royal Caribbean Cruises led the way, climbing 8.5%.

The leading cruise line operator has posted 10 consecutive quarterly deficits. It could be different this time.

SEATTLE, September 27, 2022Holland America Line and Konami Gaming, Inc. have completed the launch of the SYNKROS® casino management system across all 11 ships in the fleet

Read Also: What Cruise Lines Leave From New York Or New Jersey

Best Value Cruise Line Stocks

These are the cruise line stocks with the lowest 12-month trailing price-to-sales ratio. For companies in early stages of development or industries suffering from major shocks, this can be substituted as a rough measure of a business’s value. A business with higher sales could eventually produce more profit when it achieves profitability. The price-to-sales ratio shows how much you’re paying for the stock for each dollar of sales generated.

| Best Value Cruise Line Stocks |

|---|

Source: YCharts

Down 62% In This Bear Market Can Carnival Stock Recover In 2023

According to data from S& P Global Market Intelligence, the stock has fallen by 62% since the S& P 500 peaked on Jan. 3, 2022. Could the cruise line operator’s shares make a comeback in 2023? All cruises were put on hold in the early stages of the pandemic, and while those ships have now resumed sailing, operators including Carnival, the world’s biggest cruise line operator, have struggled to recover from their extended pause.

Don’t Miss: How Long Is The Spirit Of Philadelphia Cruise

Major Cruise Lines Held Liable For More Than $400 Million In Damages For Cuba Sailings

The Obama administration approved U.S. educational and people-to-people travel to Cuba in 2015, but a U.S. federal judge in Florida last week ordered four major cruise lines to pay more than $400 million in damages plus legal fees to a U.S. company that ran the port in Havana until it was confiscated after the Cuban

The cruise ship stock made it through the worst of the pandemic, and now needs to get back out to sea.

Investors just woke up to the fact that Carnival’s fourth-quarter earnings report actually wasn’t that great.

Companies In The News Are: BB, CCL, TTC, SIX.

Yahoo Finance’s Jared Blikre highlights key tickers moving markets at the close of the trading session.

Risks Of Cruise Line Stocks

High Debt Load: Cruise line companies racked up substantial debt over the past two years as they attempted to stay afloat during the pandemic. Carnival carried total debt of $36.39 billion at the end of the second quartermore than a three-fold increase from $11.5 billion in 2019. Royal Caribbean’s debt ballooned from $11.73 billion to $23.85 billion over the same period, while Norwegian Cruise Line’s debt grew from $6.8 billion to $13.24 billion. With inflation leading to higher fuel costs and rising interest rates, these elevated debt levels will become increasingly difficult to service, increasing the risk of share price dilution through further capital raisings.

Future Pandemics: Cruise Line stocks sank during the pandemic, with the sector facing multiple challenges from bad publicity, no-sail orders, and a sluggish recovery. In the early stages of the health crisis, reports of major outbreaks spreading onboard put downward pressure on the group. Selling accelerated as the Centers for Disease Control and Prevention issued and extended no-sail orders. Although forward bookings have bounced back in 2022, sales sit significantly below pre-pandemic levels. For example, both Carnival and Royal Caribbean reported respective revenue for the that came in at 42% and 22% below the corresponding period in 2019. These challenges remind investors that future pandemics remain a risk for cruise line stocks.

Don’t Miss: Alaska Cruises 2021 From Seattle

Advantages Of Cruise Line Stocks

A little-known benefit of holding cruise line stocks is that they offer perks. For instance, investors who hold at least 100 Carnival shares are entitled to a $250 onboard credit for cruises that are 14 days or longer, a $100 credit for cruises between 7 and 13 days, and a $50 credit for sailings of six days or less. Similarly, both Royal Caribbean and Norwegian Cruise Line offer comparable shareholder benefits. To claim, investors need to provide their details and proof of ownership, such as a shareholder proxy card or a copy of a current brokerage statement.

Pent-Up Demand: Cruise line companies have seen a bounce back in demand as customers book cruises they had put on hold during the COVID-19 pandemic. This positions operators in the sector to boost profits in upcoming quarters since most have their fleets back at total capacity and removed COVID vaccination requirements. Carnival reported in June that its forward bookings were at the higher end of historical ranges, while Royal Caribbean said in July that 2023 bookings in all quarters are currently booked within historical ranges at record pricing. Moreover, Royal Caribbean expects to return to profitability in the third quarter of 2022. As a result, cruise line stock prices may be buoyed in the months ahead as investors bake in improving earnings.

Stock Downshifts To Auto

TSLA stock rose a fraction early Tuesday.

Tesla stock rallied 8.3% to 122.40 last week, continuing a bounce from the Jan. 6 bear market low of 101.81. Shares edged down 0.9% Friday, well off intraday lows despite Tesla announcing sweeping price cuts in the U.S. and Europe. That came a week after Tesla slashed prices in China.

The latest price cuts should fuel sales, especially in the U.S., with more Tesla EV variants eligible for a $7,500 tax credit. That means a huge price cut for U.S. consumers. But Tesla’s prized margins are likely to take a hit.

Still, orders significantly lagged deliveries in late 2022, so Tesla needs a big boost in new demand just to maintain the current delivery pace in 2023.

Already-fierce competition in China will intensify in 2023, with Tesla’s price reductions perhaps triggering a wave of margin-killing cuts. Europe is increasingly crowded, as well. Even the U.S. EV market will be more competitive in a year, with the tumble in used-car prices already a big drag on new-vehicle prices.

But setting aside Tesla’s EV sales, TSLA stock has a bigger problem. Investors increasingly view the EV giant as an automaker, not a tech company. Tesla’s current price-earnings ratio of 33 is not too steep for a tech growth company. But it’s unusually high for an automaker. Auto industry advantages and margins tend to erode relatively quickly, which may be happening to Tesla right now.

Tesla Vs. BYD: EV Giants Vie For Crown, But Which Is The Better Buy?

Recommended Reading: Do You Need Passport For Cruise To Bahamas

Is Carnival Corporation Stock A Buy

Carnival holds several negative signals and this should be a sell candidate, but due to the general chance for a turnaround situation it should be considered as a hold candidate in this position whilst awaiting further development. We have upgraded our analysis conclusion for this stock since the last evaluation from a Sell to a Hold/Accumulate candidate.

Surprising Stock Picks For Contrarian

Investing against the grain is never easy. We often find ourselves buying stocks because everyone else is. Or, we sell because the herd is selling. Unfortunately, many of us never question why we may be buying or selling particular stock picks. Unfortunately, as many of us have learned the hard way, that can be a costly move. Remember, Men, it has been well said, think in herds it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one, noted Charle

Yahoo Finance Live anchor Dave Briggs looks to Carnival Cruise Line’s stock ahead of its latest earnings report due out before tomorrow’s closing bell.

You don’t need a lot of money to buy into fallen — but not broken — growth stocks. Let’s fill some stockings.

Don’t Miss: What Is The Best River Cruise Line In Europe

Holland America Line Gift Card Offer Adds A 10% Bonus Just In Time For Holiday Gifting

The season just got brighter with Holland America Line’s Holiday Gift Card offer that adds a 10% bonus gift card to gift card purchases of $250 or higher. The promotion is available to U.S. residents only, and runs from Dec. 2 13, 2022, making it easy to give the gift of future cruise travel to friends and family for the holidays.

Dow Jones Futures Fall After Market Rally Clears Resistance Tesla China Sales Get Bump

- 06:41 AM ET 01/17/2023

Dow Jones futures fell modestly Tuesday morning, along with S& P 500 futures and Nasdaq futures. Chinese economic data topped views while Tesla’s China EV registrations got a boost after big price cuts there.

The stock market rally picked up steam in the past week, with strong gains, clearing key levels. The S& P 500 briefly faced resistance at the 200-day line, but moved above that key level on Friday. A large number of leading stocks flashed buy points.

Investors can be adding exposure gradually as the market rally improves. While many top stocks are now extended, Wendy’s , Exxon Mobil , Quanta Services , Celsius Holdings and Insulet are all actionable from early entries. Wendy’s and PWR stock have new flat bases, joining XOM stock and Insulet. CELH stock needs another week to forge a proper base.

CELH stock is on SwingTrader and the IBD 50. Celsius, Insulet and Wendy’s were the most recent three IBD Stock Of The Day selections.

Meanwhile, Tesla on Friday announced big price cuts in the U.S. and Europe, a week after slashing prices in China and key Asian markets. Early Tuesday, weekly Chinese EV registration data showed an initial sales boost from the China cuts.

Tesla stock closed modestly lower Friday but rebounded solidly for the week. Still, the EV giant faces a painful transition as investors increasingly view Tesla as an automaker, not a tech company.

Recommended Reading: What Cruise Ships Go To Key West

Fun Stocks Making Waves On Wednesday

The Dow Jones Industrial Average and other popular stock indexes were higher by around midday. A couple of companies specializing in helping their customers enjoy themselves were in the news Wednesday morning, and although one of them faces ongoing challenges that caused its share price to drop, another gained on outside interest from institutional investors. Here’s why the market is watching Carnival and Six Flags Entertainment today and what it means for long-term investors.

Carnival posts an adjusted fiscal fourth-quarter loss of 85 cents a share on revenue of $3.84 billion.

Fastest Growing Cruise Line Stocks

These are the cruise line stocks with the highest year-over-year sales growth for the most recent quarter. Rising sales can help investors to identify companies that are able to grow revenue organically or through other means and to find growing companies that have not yet reached profitability. In addition, accounting factors that may not reflect the overall strength of the business can significantly influence earnings per share . However, sales growth can also prove potentially misleading about the strength of a business because growing sales on money-losing businesses can be harmful if the company has no plan to reach profitability.

| Fastest Growing Cruise Line Stocks |

|---|

Source: YCharts

- Norwegian Cruise Line Holdings Ltd.: See above for company description.

- Royal Caribbean Group: Royal Caribbean Group, formerly known as Royal Caribbean Cruises, operates a fleet of vessels in the cruise vacation industry. On Aug. 30, Royal Caribbean announced that it will offer high-speed internet to passengers throughout its entire cruise fleet through SpaceX’s Starlink, a high-speed internet service. The installation is scheduled to be completed by the end of Q1 2023 and is expected to sharply improve historically poor internet service while cruise vessels are at sea.

- Carnival Corp.: See above for company description.

These are the cruise line stocks that had the smallest declines in total return over the past 12 months out of the companies we looked at.

Don’t Miss: Caribbean Cruises From New York