Cruise Travel Insurance For Trip Cancellation

If youre forced to cancel your cruise, how much of that prepaid trip cost could you get back? There are often cancellation penalties tied to travel purchases, especially cruise trips, and you could get a portion of your trip costs back or none at all. Those penalties tend to get more severe as the departure date gets closer. This is where Trip Cancellation coverage can help you.

Many things can happen between the time you book your cruise and the start of your vacation that could affect you or your traveling companions or family members and force you to cancel your tripsickness, job loss, and even flight cancellations due to adverse weather or an airline strike. Luckily, travel insurance is a small investment against the full cost of a cruise and Generali Global Assistance plans include Trip Cancellation coverage that can provide reimbursement for a canceled trip. This could be an especially important coverage if youre cruising during hurricane season.

Where Should I Buy My Policy

While cruise lines typically offer customers the option to opt-in to their insurance, these policies are often limited, and only cover expenses purchased directly through the cruise line. For this reason, Squaremouth always recommends shopping around and comparing policies from multiple sources to find the most comprehensive coverage for your trip for the lowest possible price. This can include a comparison site like Squaremouth.com, a travel insurance provider, or directly from the cruise line.

Tip for Cruisers: Travel insurance isnât a one-stop-shop, and cruisers especially have many options. Determine which benefits are most important to you, and select the policy with the most coverage within those benefits for the best price.

Trip Cancellation/interruption Insurance Coverage

The most basic cruise insurance policies cover you in case your trip is canceled or interrupted. These policies reimburse you for actual losses up to your coverage limits when:

- You must cancel due to a covered reason.

- You have to return home early due to a covered reason.

- There is a covered departure delay.

You May Like: When Is The Best Time To Cruise The Mediterranean

Where Are You Going

Did you know the cost of travel insurance isnt affected by your choice of destination? It doesnt matter if youre heading to Iceland or Cambodia the quotes you receive are determined solely by your trip cost and your age.

However, your destination is an important factor when youre thinking about how much travel insurance to buy. Thats because if youre heading overseas, youll need the additional protection of emergency medical benefits and emergency medical transportation benefits. And if youre visiting more remote areas, theres a greater chance youll require expensive emergency medical assistance.

For instance, lets say a traveler falls and breaks his ankle while on a walking tour in Paris. Fortunately, several high-quality hospitals are just a short ambulance ride away. Travel insurance can pay for emergency medical care and emergency medical transportation required by his covered serious injury but the total bill is unlikely to be astronomical. A plan like OneTripSM Basic, with up to $10,000 in emergency medical/dental and up to $50,000 in emergency medical transportation, may be enough.

Be Wary Of Cruise Line Coverage

Cruise lines often ask consumers booking a cruise to buy the lines own protection at the time of purchase. But if specifics about the coverage are lacking, always ask the line for details in advance, review coverage perks and limits and then compare those to one or two independent travel insurance policies, or your credit cards insurance benefits.

Cruise line travel insurance policies sometimes have quirks. Many cruise companies will only offer a travel voucher or credit for future use in the event of a covered cancellation, not an outright refund.

Also, financial default may not be a covered event in a cruise line-sold policy. But its typically covered with plans from third-party travel insurance companies.

Cruise line policies also can be more restrictive.

Cruise line insurance seems to have become better and has more widespread coverage than in the past, but it typically wont cover air or pre- and post-travel unless those elements are purchased through , said Debra Kerper, a Cruise Planners travel adviser from Carrollton, Texas, who books travel and sells private insurance. This is when private insurance coverage becomes so very important.

Related: The extreme measures cruise lines are taking as coronavirus spreads

You May Like: Where Is The Cruise Port In Amsterdam

Get The Right Cover For Your Destination For The Right Length Of Time

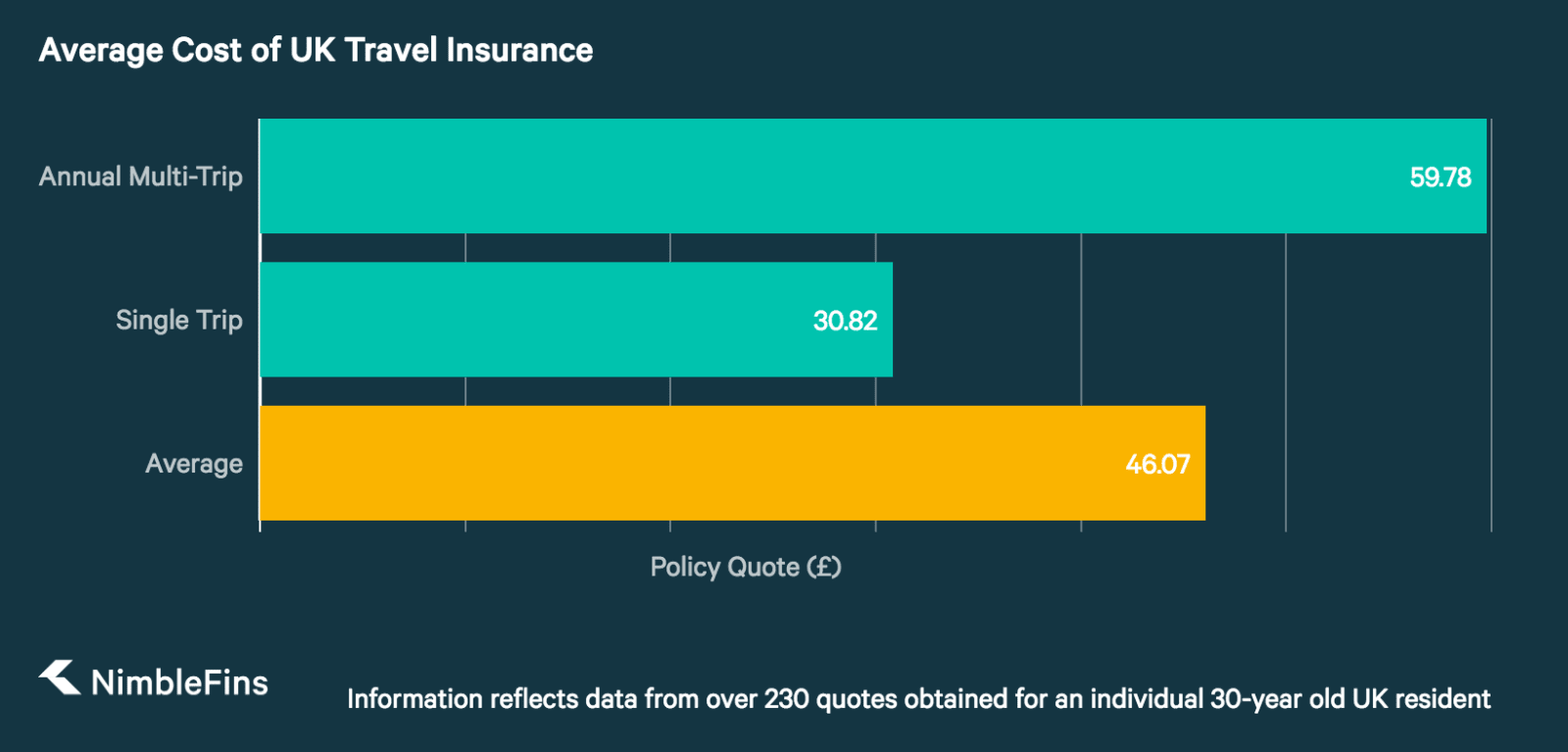

If youre going on more than one cruise this year, or combining a cruise with a city break or a few weeks at the beach, annual multi-trip travel insurance sometimes works out better value for money than buying a single-trip policy for each break away.

Annual policies cover every trip you make throughout the year, just make sure it covers all your destinations – you can buy European or worldwide policies, depending on where youre going.

Multi-trip policies usually have limits to how many days each individual trip can be. If youre cruising for an extended period of time, look at long-stay travel insurance.

You Cant Predict The Weather

Cruising is a great way to explore multiple destinations in one trip. But its good to keep in mind that unexpected delays, interruptions or cancellations due to weather can happen during cruises, particularly during hurricane seasons in places such as the Caribbean and Asia .

During the 2018 Atlantic hurricane season Allianz paid 6,238 claims from customers whose travel plans in the Caribbean, Gulf of Mexico and southeastern U.S. were impacted by the storms, according to Daniel Durazo, director of communications and marketing for Allianz Global Assistance USA.

If youre hoping to insure against a storm-related disaster, its good to buy travel insurance as early as possible. Once a storm or hurricane is named, its too late to buy travel insurance to cover it.

Of course, cruise lines will move ships away from a weather threat. But when the port line-up is adjusted, or the cruise shortened, they might only offer the guest an onboard credit, onboard gift or future cruise credit, rather than any refund. It depends on circumstances for that specific voyage.

Related: Everything you need to know about cruising during hurricane season

Recommended Reading: What Cruise Ships Sail Out Of Mobile Alabama

All Medical Conditions Considered

If you have medical conditions, this should not be a reason to hold you back from exploring the world. Having the right cover in place, should the unfortunate happen, will give you peace of mind while on your adventures.

It’s important that you declare all your medical conditions and any medication that you’re taking.

Post Office Travel Insurance covers most pre-existing medical conditions. Get a quote today to see if we can cover you. If you have a serious pre-existing medical condition that Post Office Travel Insurance cannot offer cover for, the Money and Pensions Scheme have launched a directory listing companies that may be able to help you. The directory can be accessed by either or calling 0800 138 7777.

What Expenses Should I Insure For My Cruise

Cruisers have the option to insure all, some, or none of their trip expenses when booking a cruise. Squaremouth recommends travelers insurance all of their non-refundable deposits. This can include cruise expenses, such as a down payment and excursions, as well as travel expenses in addition to the cruise, such as airfare and hotel accommodations.

Tip for Cruisers: Only insure the amount you would lose if you cancel. For example, if you only have to put down a deposit up front, you can choose to insure the deposit amount and add to it as you make additional payments closer to your departure date.

Don’t Miss: Bus From London To Southampton Cruise Terminal

Does Cruise Ship Travel Insurance Cover Pre

Many cruise passengers are older people with the time to sail around exploring the world at their leisure, so cruise insurance providers are used to accommodating travellers with pre-existing health problems.

While treatment relating to undisclosed pre-existing medical conditions is often excluded by cruise insurance providers, you can therefore get cover for most conditions as long as you are upfront about them.

Medical conditions you should always disclose when taking out cruise insurance include:

- diabetes

- heart disease

- cancer.

If youre unsure whether or not a condition needs to be disclosed, the best policy is to tell your insurer about it anyway it could save you thousands of pounds if you need related care while youre away.

What Should You Look For In A Cruise Insurance Plan

Before comparing cruise insurance plans, lets identify some of the features you should look for when shopping around:

- Generous emergency medical and emergency medical transportation benefits. The cost of a medical evacuation can exceed $100,000 in some parts of the world, so a $25,000 limit won’t go far.1

- A broad range of covered reasons for trip cancellation/interruption. If you cancel for a reason that’s not covered, cruiselines protection plans may give you cruise credits that are worth less than the amount of your trip or nothing at all.

- Robust trip delay coverage. If your flight into Miami is delayed and you miss your cruise ship’s sailing, it may cost you quite a lot to catch up with the ship at its next port of call.

Supplier default coverage. If your cruise line or tour operator goes out of business, you need to make sure you’ll recoup your travel investment.

Don’t Miss: How Much Does A 7 Day Caribbean Cruise Cost

Allianz Global Assistance Travel Insurance

The OneTrip Prime Plan from Allianz Global Assistance is one of our most popular travel insurance plans for cruises. For starters, OneTrip Prime includes a long list of covered reasons for trip cancellation/interruption, giving travelers the confidence that theyre covered for the most common travel mishaps. Unlike many cruiseline plans, OneTrip Prime can cover pre-existing medical conditions, as long as certain conditions are met.

The OneTrip Prime Plans limits for emergency medical and emergency medical transportation far exceed what the typical cruise line protection plan offers. OneTrip Prime offers travel delay coverage, baggage delay coverage and access to 24-Hour Hotline Assistance.

Depending on where you live, the OneTrip Prime plan may also include the Epidemic Coverage Endorsement, which adds certain epidemic-related covered reasons for Trip Cancellation/Interruption Travel Delay Emergency Medical Care and Emergency Transportation benefits. For example, you may be reimbursed for prepaid, nonrefundable, unused trip costs if you must cancel your trip because you, a travel companion, or a family member are diagnosed with an epidemic disease such as COVID-19. For more information, look for the Epidemic Coverage Endorsement page within your plan details. (Not available in all jurisdictions. For plans without this endorsement, certain limited-time COVID-19 claim accommodations may be available. Read our

Cancel For Any Reason

As the phrase suggests, you can cancel your trip for any reason — a luxury normal insurance policies won’t allow. Most insurers require this policy add-on be purchased between 14 and 21 days following your final cruise payment.

Read the description of coverage to find out what percentage of your trip deposits are reimbursed under this type of “cancel for any reason” terminology. Most policies max out the coverage at 75 percent of the trip costs, but some cover as little as 50 percent.

These policies are more expensive but make sense in certain circumstances — say, a particularly costly itinerary or during a known event such as the world-wide coronavirus pandemic.

Read Also: Average Cost Of A 7 Day Caribbean Cruise

What Does Cruise Travel Insurance Cover

A cruise vacation has so many moving parts, including the sheer number of destinations you visit, flights, and hotels bookings. Things can go wrong after youve made that final deposit, and without travel insurance, youd likely lose that payment, says Colleen McDaniel, editor-in-chief of cruise review and community site Cruise Critic.

While specific policies vary in their coverageyoull need to review the fine print carefully before you buymost offer recourse for commonly encountered issues like the need to cancel a trip or trip delays and interruptions. If you miss your initial embarkation of a cruise due to a flight delay or a weather event, such as a hurricane or winter storm, travel insurance could help cover the costs of you getting to the next port of call, so you can join your cruise, says James Page, senior vice president and chief administrative officer of AIG Travel, whose subsidiaries sell policies designed to cover cruisers.

Weather is not covered unless it results in the cancellation of or significant interruption to the cruise. McDaniel says that you wont get a refund if the scheduled ports visited on a cruise itinerary are changed due to bad weather. Skipped ports would not be covered by travel insurance, she says, in cases of inclement weather.

Travel Insurance And Coronavirus

When buying travel insurance, check whether the policy provides cancellation cover that includes coronavirus risks, including if you fall ill or need to isolate before you travel. You should also have cover in case you fall ill while you are away. Read the policy documents and check levels of cover with the insurer if you are not sure what protection is provided.

Going on a cruise is a great way to see a wealth of different sights without having to pack and unpack your suitcase between each destination.

You can glide around the Norwegian fjords, explore the islands of the Caribbean, tour the Mediterranean or even circumnavigate the globe if youve the time and the money.

But whatever your itinerary, your cruise could easily be disrupted by adverse weather conditions that delay your journey or stop you visiting one or more of the ports on the list.

Thats why cruise companies generally reserve the right to change their itineraries at any time.

Its also one of the main reasons why its sensible to take out specialist cruise ship travel insurance before you sail into the sunset.

You May Like: When Is The Best Time To Cruise The Mediterranean

How To Obtain Travel Insurance And Medical Evacuation Coverage

Demand for travel insurance is rising. “The number of policies sold through July 2021 from a year ago nearly tripled from the Covid-depressed level of 2020,” said Starr Insurance Companies spokesperson Christopher Winans. And it “was up 63% from the 2018 pre-Covid level.”

Most Starr travel policies include medical evacuation coverage.

You can buy coverage from each cruise operator. Each one works with an underwriter. Or you can buy your own policy or add coverage to an existing policy.

In each case, each cruise line spells out what sort of documentation you must provide to board.

Can I Take Out Group Cruise Ship Travel Insurance

Yes, you can take out cruise insurance that covers you, you and your spouse or partner, you and your family, or you and a group of friends.

Just make sure you have their dates of birth and details of any pre-existing health conditions to hand when youre ready to buy your cruise insurance.

Cruise policies do not generally impose an upper age limit, so you should be able to find cover for your friends or relatives whatever their age. However, travellers over the age of say 70 or 80 will push the cost of the policy up considerably, so it may prove cheaper to get separate cover for these individuals if youre in a group.

Read Also: Average 7 Day Cruise Cost

Carnival Travel Insurance Quotes

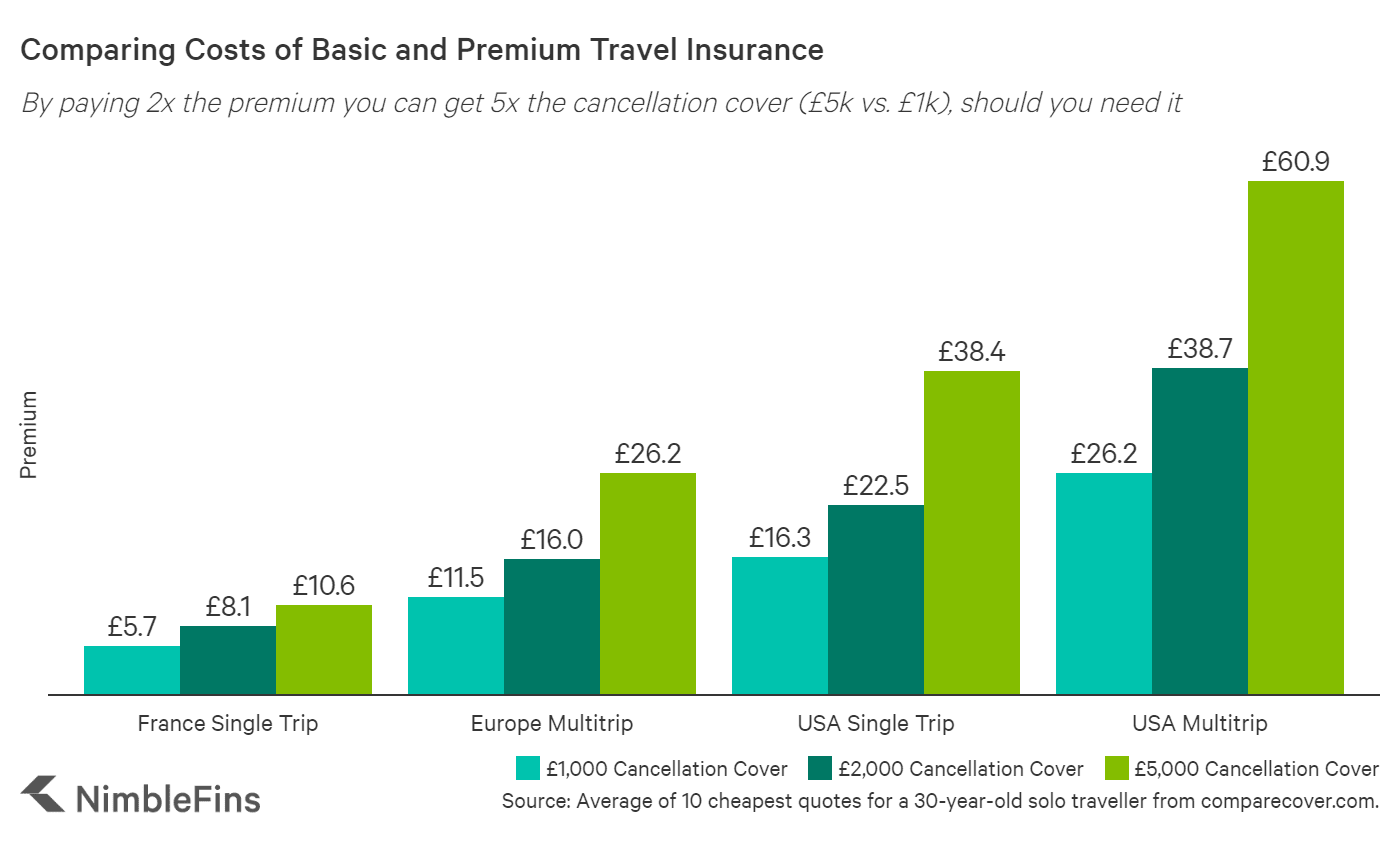

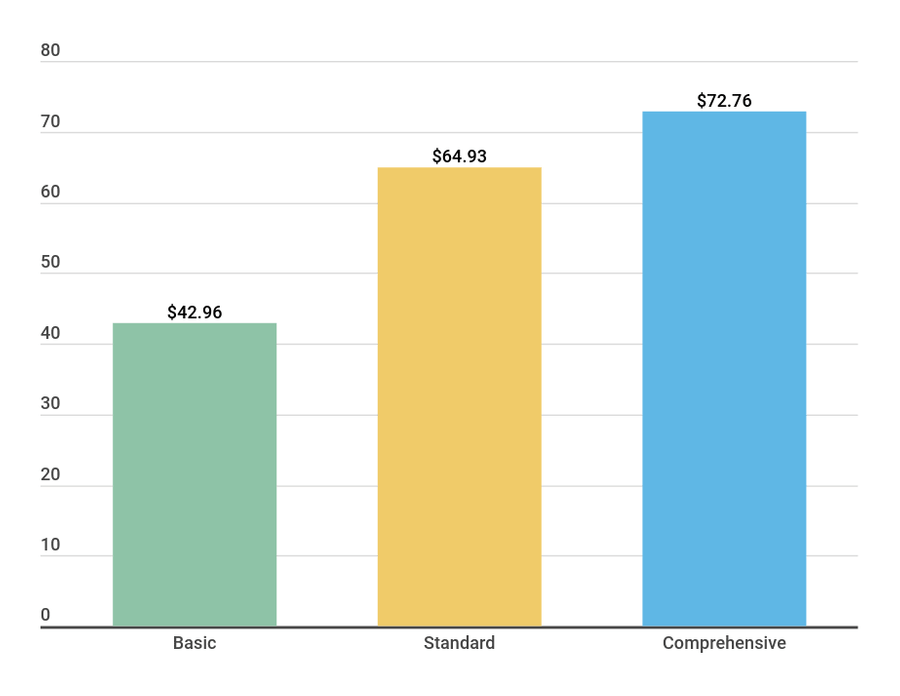

When budgeting for a vacation, its best to set aside an amount approximately 4 to 8 percent of the total cost of travel. However, its important to keep in mind that this range is based on the average vacation and may vary depending on several factors, including the travelers age and health condition, the date, length, and method of travel, and the destination.

Its best to contact Carnival directly to receive an accurate quote.

Weve Partnered With Holiday Extras To Offer Cover For Our Holidays

Holiday Extras offer cruise-specific travel insurance policies perfect for your next holiday. One of the key benefits is that this cruise-specific cover includes things most travel insurance policies dont cover as standard, such as missed ports, missed shore experiences and cabin confinement.

Holiday Extras offer three levels of cover to choose from: bronze, silver and gold. All of these available options meet our minimum requirements for travel insurance and the gold policy offers enhanced cover for cancellations as a result of COVID. Tailored options are also available from Holiday Extras should you have pre-existing medical conditions.

To find out more, visit www.holidayextras.com/pocruisesor phone 0800 093 3070 and quote PAOHX.

Don’t Miss: Cape Liberty Nj Cruises

Does Normal Travel Insurance Cover Cruises

Cruises are a great way to see the world, but theyre different to traditional fly and stop holidays. Certain things that happen at sea usually arent covered by a standard policy, which is what makes Cruise travel insurance a useful add-on if youre heading out on the open water.

Cruise travel insurance is specifically designed for those holidaying on a ship. It accounts for unique issues, such as missing the cruises departure because your car breaks down on route to the port or being confined to your cabin through illness. It even considers the fact that youre moving from port to port, rather than staying in one place the planned itinerary could change, and you may miss a port or not get chance to do an excursion you booked. With standard travel insurance, you wouldnt be covered for these things. But, if you take out travel insurance with Cruise cover, youre protected so you can just enjoy your holiday.

Which Cruise Lines Require Mandatory Travel Insurance

With hopes of a tourism rebound, countries and cruise lines are making safety a top priority. Although vaccines, safety precautions, and COVID test requirements are helping to prevent the spread of COVID-19, theres one more safeguard that cruise lines in particular are counting on: mandatory travel insurance. This isnt a requirement for all countries or all cruise lines, but regardless, its a smart idea to purchase travel insurance for your upcoming vacation.

Recommended Reading: Small World Vacations Onboard Credit