Norwegian Cruise Lines Stock Is A Buy Analyst Says Booking Trends Look Strong

Norwegian has shared a boat load of bad news recently, but a Stifel analyst says its time to buy the cruise liners stock given the strength in booking and pricing patterns.

Norwegian Cruise Line Holdings stock has slumped 4% since its earnings report on Aug. 9. Its latest quarterly revenue missed estimates, and the company said it would continue to be unprofitable in the third quarter.

Recommended Reading: What Cruise Lines Leave From Cape Liberty Nj

Why You Should Buy The Dip On This Cruise Line Stock

With the cruise industry showing signs of recovery, it might finally be time to buy the dip on this American cruise line stock. It was 14% higher than 2019 levels and above Norwegian’s own expectations. Total revenue landed at $1.6 billion — the upper end of Norwegian’s expected range but more than 15% below Q3 2019 levels.

Yahoo Finance Live’s Seana Smith examines several trending stocks in the after-hours trading session.

Norwegian Cruise Line Holdings To Hold Conference Call On Third Quarter 2022 Financial Results

Company Invites all NCLH Shareholders to Submit Questions for Management Ahead of Earnings CallMIAMI, Oct. 31, 2022 — Norwegian Cruise Line Holdings Ltd. announced today it will report third quarter 2022 financial results on Tuesday, November 8, 2022 at 7:30 a.m. Eastern Time with a conference call and webcast to discuss results at 10:00 a.m. Eastern Time. The Company also invit

Don’t Miss: What Cruise Ships Sail Out Of New Orleans

Guidance & Booking Updates

Due to the coronavirus pandemic and the Russia-Ukraine conflict, the company is unable to estimate the impact on its business. The company expects to report a net loss for third-quarter 2022. In third-quarter 2022, it anticipates net interest expenses to be nearly $160 million. For the full year, it expects the same to be $615 million, excluding losses on extinguishment of debt. Depreciation and amortization are forecast to be roughly $190 million for the third quarter of 2022 and $745 million for the full year of 2022.The company expects occupancy to be in the low 80% range in the third quarter of 2022. Capacity days are anticipated to be 5 million in the third quarter and 5.1 million in the fourth quarter. In the third quarter, the company expects revenues to be in the range of $1.5-$1.6 billion. Adjusted net cruise cost is likely to decline by nearly 10% in the second half of 2022 compared to the first half of 2022.The cumulative booked position for the second half of 2022 continues to be below the comparable 2019 period. However, booking trends for 2023 remain in line with a record of 2019.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates have trended downward during the past month.

The consensus estimate has shifted -235.34% due to these changes.

VGM Scores

Overall, the stock has an aggregate VGM Score of D. If you arent focused on one strategy, this score is the one you should be interested in.

Outlook

> > > 5 Best Inflation Stocks For 2022 < < <

The insiders hold 0.40% of the companys shares while institutions hold 58.80%. The data shows that short shares as of Oct 13, 2022, stood at 42.2 million at a short ratio of 1.59. This represents a 10.01% short interest in shares outstanding on Oct 13, 2022. Shares short rose in October from the previous month at 39.14 million. Investors should be excited about this stock as its upside potential is great, with todays price pushing the stock -21.84% down in year-to-date price movement.

Also Check: Cruise And Tour Travel Agency

Norwegian Cruise Line Holdings Ltd Stock Rises Thursday Outperforms Market

rising 0.61% to 31,774.52. This was the stocks fourth consecutive day of gains. Norwegian Cruise Line Holdings Ltd. closed $15.17 below its 52-week high , which the company reached on November 5th.

The stock underperformed when compared to some of its competitors Thursday, as Royal Caribbean Group RCL, +3.17% rose 2.65% to $10.08. Trading volume eclipsed its 50-day average volume of 19.8 M.

Editors Note: This story was auto-generated by Automated Insights, an automation technology provider, using data from Dow Jones and FactSet. See our market data terms of use.

Just in time for the likely depressing final act, celebrity Kim Kardashian enters the private-equity act. With public markets swooning, can private ones be far behind?

Norwegian Cruise Line Stock Up 07 %

Want More Great Investing Ideas?

Norwegian Cruise Line last issued its earnings results on Tuesday, November 8th. The company reported EPS for the quarter, beating analysts consensus estimates of by $0.05. Norwegian Cruise Line had a negative return on equity of 180.24% and a negative net margin of 88.14%. The firm had revenue of $1.62 billion for the quarter, compared to analyst estimates of $1.58 billion. Equities analysts anticipate that Norwegian Cruise Line Holdings Ltd. will post -4.72 EPS for the current year.

Also Check: What Cruise Lines Depart From New Jersey

These Stocks Soared Up To 12% After Inflation Cooled

DEEP DIVE Amid the euphoria following what appeared to be the first sign of slowing inflation, stocks staged a broad rally on Aug. 10, with dozens of large-cap stocks rising 5% or more. Those included several tech names that investors loved during the early stages of the coronvirus pandemic, along with cruise lines, credit-card lenders and chip-related companies.

Norwegian, the first cruise line to drop mandatory covid vaccinations for U.S. sailings, sees calmer waters ahead.

Is Norwegian Cruise Line Stock Undervalued Or Overvalued

Valuing Norwegian Cruise Line stock is incredibly difficult, and any metric has to be viewed as part of a bigger picture of Norwegian Cruise Line’s overall performance. However, analysts commonly use some key metrics to help gauge the value of a stock.

Norwegian Cruise Line’s PEG ratio

Norwegian Cruise Line’s “price/earnings-to-growth ratio” can be calculated by dividing its P/E ratio by its growth to give 0.9247. A low ratio can be interpreted as meaning the shares offer better value, while a higher ratio can be interpreted as meaning the shares offer worse value.

The PEG ratio provides a broader view than just the P/E ratio, as it gives more insight into Norwegian Cruise Line’s future profitability. By accounting for growth, it could also help you if you’re comparing the share prices of multiple high-growth companies.

You May Like: 7 Night Greek Isles Cruise

Is It A Good Time To Buy Norwegian Cruise Line Stock

The technical analysis gauge below displays real-time ratings for the timeframes you select. This is not a recommendation, however. It represents a technical analysis based on the most popular technical indicators: Moving Averages, Oscillators and Pivots. Finder might not concur and takes no responsibility.

This chart is not advice or a guarantee of success. Rather, it gauges the real-time recommendations of three popular technical indicators: moving averages, oscillators and pivots. Finder is not responsible for how your stock performs.

Norwegian Cruise Line Donates Juneau Waterfront Parcel For New Pier Development

Norwegian Cruise Line Holdings Ltd is donating its undeveloped waterfront property in Juneau, Alaska, to the native-owned Huna Totem Corporation. Huna Totem is a long-standing partner and a local leader in Alaska’s tourism development. Huna Totem will develop a new pier and related infrastructure on the parcel and submit plans for the year-round facility before 2022-end. Norwegian Cruise Line will receive preferential berthing rights at the pier once development is complete. The fut

Recommended Reading: What To Do In Port Canaveral Cruise Stop

Norwegian Cruise Line Holdings Q3 2022 Earnings Call Transcript

Image source: The Motley Fool. Norwegian Cruise Line Holdings Q3 2022 Earnings CallNov 08, 2022, 10:00 a.m. ETContents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks: OperatorGood morning and welcome to the Norwegian Cruise Line Holdings’ business update and third quarter 2022 earnings conference call.

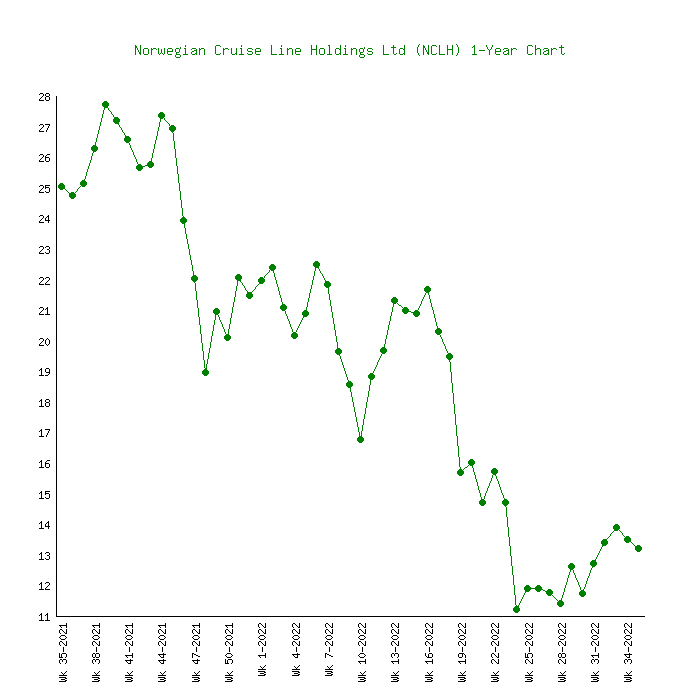

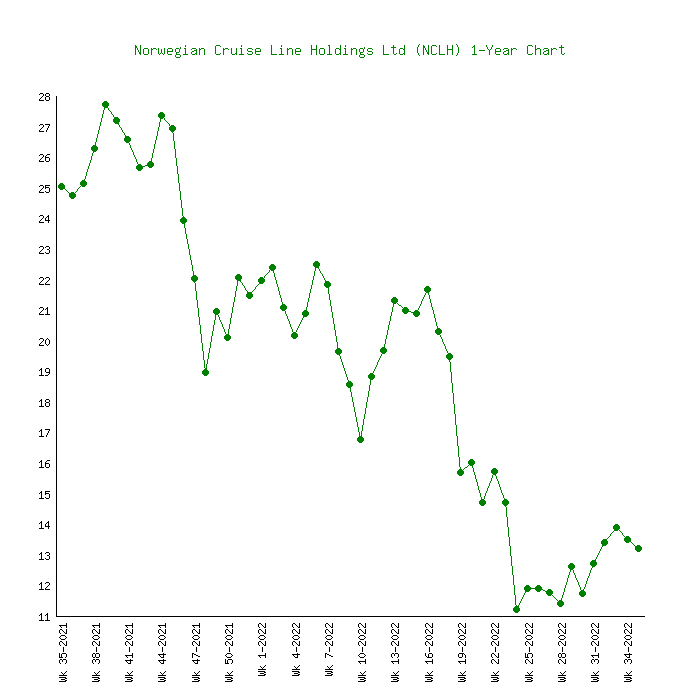

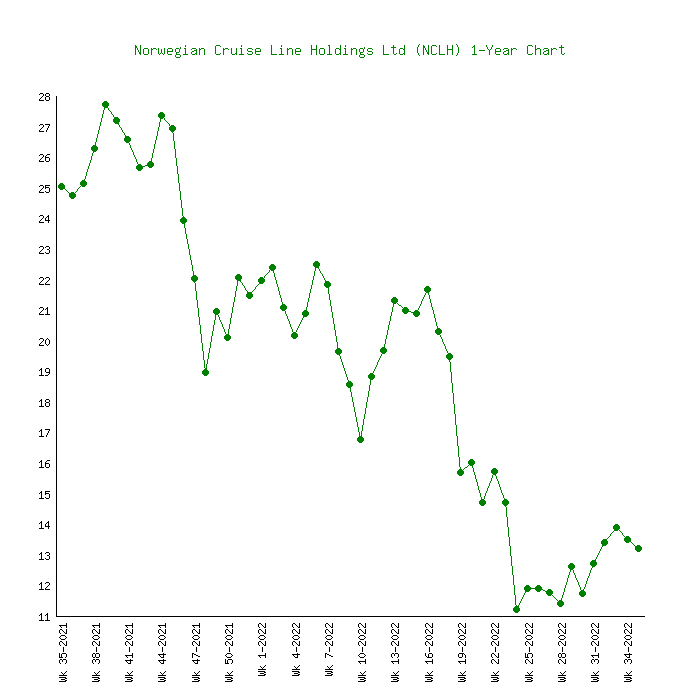

Norwegian Cruise Line Price Performance

Shares of NYSE NCLH opened at $16.43 on Friday. The firm has a market capitalization of $6.92 billion, a P/E ratio of -1.98 and a beta of 2.47. Norwegian Cruise Line Holdings Ltd. has a one year low of $10.31 and a one year high of $23.90. The companys fifty day moving average is $15.07 and its two-hundred day moving average is $13.98. The company has a debt-to-equity ratio of 32.25, a quick ratio of 0.43 and a current ratio of 0.46.

Norwegian Cruise Line last released its quarterly earnings data on Tuesday, November 8th. The company reported EPS for the quarter, topping the consensus estimate of by $0.05. Norwegian Cruise Line had a negative net margin of 88.14% and a negative return on equity of 180.24%. The business had revenue of $1.62 billion for the quarter, compared to analyst estimates of $1.58 billion. Analysts forecast that Norwegian Cruise Line Holdings Ltd. will post -4.72 EPS for the current fiscal year.

Recommended Reading: What To Do In Juneau Cruise Port

Toronto Dominion Bank Buys 16013 Shares Of Norwegian Cruise Line Holdings Ltd

Posted by on Nov 26th, 2022

Toronto Dominion Bank lifted its position in shares of Norwegian Cruise Line Holdings Ltd. by 8.6% during the second quarter, Holdings Channel.com reports. The institutional investor owned 202,665 shares of the companys stock after acquiring an additional 16,013 shares during the quarter. Toronto Dominion Banks holdings in Norwegian Cruise Line were worth $2,253,000 as of its most recent SEC filing.

Trading Expectations For The Upcoming Trading Day Of Tuesday 29th

For the upcoming trading day on Tuesday, 29th we expect Norwegian Cruise Line Holdings Ltd. to open at $16.06, and during the day ,to move between $14.98 and $16.79,which gives a possible trading interval of +/-$0.90 up or down from last closing price.If Norwegian Cruise Line Holdings Ltd. takes out the full calculated possible swing range there will be an estimated 11.37% move between the lowest and the highest trading price during the day.

Since the stock is closer to the support from accumulated volume at $15.31 than the resistance at $16.79 ,our systems sees the trading risk/reward intra-day as attractive and believe profit can be made before the stock reaches first resistance..

Recommended Reading: When Is The Cheapest Time To Cruise

Earnings & Revenue Discussion

Norwegian Cruise reported an adjusted loss per share of $1.14, wider than the Zacks Consensus Estimate of a loss of 82 cents. In the prior-year quarter, the company reported a loss per share of $1.93.Quarterly revenues of $1,187.2 million lagged the consensus mark of $1,264 million. In the prior-year quarter, the company had reported revenues of $4.4 million. The upside can primarily be attributed to the resumption of cruise operations. In the quarter under review, passenger ticket revenues were $793.9 million compared with $1.5 million reported in the prior-year quarter. Onboard and other revenues increased to $393.3 million from $2.8 million reported in the prior-year quarter.

Notes & Data Providers

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright © FactSet Research Systems Inc. All rights reserved. Source: FactSet

Indexes: Index quotes may be real-time or delayed as per exchange requirements refer to time stamps for information on any delays. Source: FactSet

Data on U.S. Overview page represent trading in all U.S. markets and updates until 8 p.m. See Closing Diaries table for 4 p.m. closing data. Sources: FactSet, Dow Jones

Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Sources: FactSet, Dow Jones

ETF Movers: Includes ETFs & ETNs with volume of at least 50,000. Sources: FactSet, Dow Jones

Bonds: Bond quotes are updated in real-time. Sources: FactSet, Tullett Prebon

Currencies: Currency quotes are updated in real-time. Sources: FactSet, Tullett Prebon

Cryptocurrencies: Cryptocurrency quotes are updated in real-time. Sources: CoinDesk , Kraken

Calendars and Economy: ‘Actual’ numbers are added to the table after economic reports are released. Source: Kantar Media

Read Also: What Is The Cheapest Cruise

Why Is Norwegian Cruise Line Up 35% Since Last Earnings Report

Zacks Equity Research

You follow Realtime BLOG edit

You follow Zacks Equity Research edit

What would you like to follow?

Zacks Equity Research

A month has gone by since the last earnings report for Norwegian Cruise Line . Shares have added about 3.5% in that time frame, outperforming the S& P 500.

Will the recent positive trend continue leading up to its next earnings release, or is Norwegian Cruise Line due for a pullback? Before we dive into how investors and analysts have reacted as of late, lets take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Norwegian Cruise Line Overview

Norwegian Cruise Line Holdings Ltd. , together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various locations, including destinations in Scandinavia, Russia, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean. As of December 31, 2021, the company had 28 ships with approximately 59,150 berths. It distributes its products through retail/travel advisor and onboard cruise sales channels, as well as meetings, incentives, and charters. Norwegian Cruise Line Holdings Ltd.

Read Also: What Is The Largest Cruise Line

Norwegian Cruise Line’s Environmental Social And Governance Track Record

Environmental, social and governance criteria are a set of three factors used to measure the sustainability and social impact of companies like Norwegian Cruise Line.

When it comes to ESG scores, lower is better, and lower scores are generally associated with lower risk for would-be investors.

Norwegian Cruise Line’s total ESG risk score

Total ESG risk: 29.48

Socially conscious investors use ESG scores to screen how an investment aligns with their worldview, and Norwegian Cruise Line’s overall score of 29.48 is nothing to write home about landing it in it in the 52nd percentile of companies rated in the same sector.

ESG scores are increasingly used to estimate the level of risk a company like Norwegian Cruise Line is exposed to within the areas of “environmental” , “social” , and “governance” .

Norwegian Cruise Line’s environmental score

Environmental score: 16.54/100

Norwegian Cruise Line’s environmental score of 16.54 puts it squarely in the 6th percentile of companies rated in the same sector. This could suggest that Norwegian Cruise Line is a leader in its sector terms of its environmental impact, and exposed to a lower level of risk.

Norwegian Cruise Line’s social score

Social score: 13.47/100

Norwegian Cruise Line’s social score of 13.47 puts it squarely in the 6th percentile of companies rated in the same sector. This could suggest that Norwegian Cruise Line is a leader in its sector when it comes to taking good care of its workforce and the communities it impacts.

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

- Gear advertisements and other marketing efforts towards your interests.

To learn more about how we handle and protect your data, visit our privacy center.

Recommended Reading: What Cruise Ships Are In Port Canaveral

Norwegian Cruise Line Holdings Q2 2022 Earnings Call Transcript

Image source: The Motley Fool. Norwegian Cruise Line Holdings Q2 2022 Earnings CallAug 09, 2022, 10:00 a.m. ETContents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks: OperatorGood morning, and welcome to the Norwegian Cruise Line Holdings business update and second quarter 2022 earnings conference call.

Norwegian Cruise reported disappointing earnings and is trading lower. If it breaks a particular level, new lows could be in store.

Oceania Cruises Announces 2024

Oceania Cruises, the world’s leading culinary- and destination-focused cruise line, announced its most extensive, expansive, and immersive series of World and Grand Voyages for 2025. The line reprised its perennially popular Around the World in 180 Days voyage for 2025, albeit in a very unique east-to-west navigation. Underscoring the increasing popularity of the brand’s demand for longer, languid, destination-immersive voyages, Oceania Cruises also introduced a series of seven Grand Voyages ran

Norwegian Cruise Line has very quietly done something that will delight many, or even most, of its customers, while it makes a few mad.

Companies in The News Are: INTU, NCLH, JWN, DY

Yahoo Finance’s Jared Blikre looks at what stocks and sectors made the biggest moves in the market on Tuesday afternoon.

The cruise line has done something that may also benefit Royal Caribbean, Carnival, and other cruise lines.

Recommended Reading: What Cruises Out Of Galveston

Wall Street Analyst Weigh In

Several equities analysts have issued reports on the company. Deutsche Bank Aktiengesellschaft cut their target price on Norwegian Cruise Line from $16.00 to $14.00 and set a hold rating on the stock in a research note on Friday, November 11th. Susquehanna Bancshares decreased their target price on shares of Norwegian Cruise Line from $20.00 to $15.00 and set a positive rating for the company in a research report on Wednesday, August 10th. Susquehanna lifted their price target on shares of Norwegian Cruise Line from $15.00 to $20.00 in a report on Wednesday, November 9th. Morgan Stanley decreased their price objective on Norwegian Cruise Line from $14.00 to $13.00 and set an equal weight rating for the company in a report on Friday, August 12th. Finally, Citigroup boosted their target price on Norwegian Cruise Line to $18.00 in a research note on Tuesday, November 15th. One equities research analyst has rated the stock with a sell rating, four have given a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the companys stock. According to data from MarketBeat, the company currently has a consensus rating of Moderate Buy and a consensus target price of $19.17.