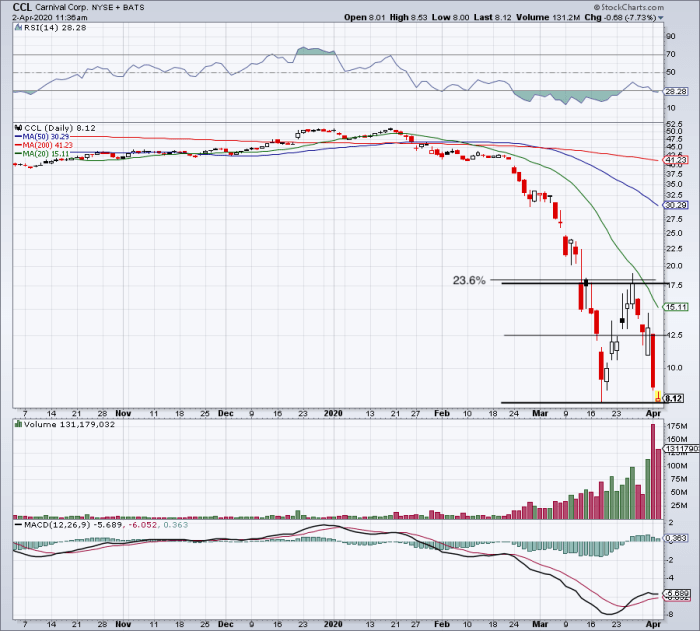

What To Do Now

A choppy market rally is dangerous because it lures investors into stocks that are flashing buy signals, then immediately reverses lower.

But let’s say you bought on relative weakness in the market, such as pullbacks to the 21-day line, over the past few weeks? Well, the indexes are all undercutting their recent lows. So even those trades are likely struggling unless you took quick profits.

Investors should probably be reducing exposure, if only because individual stocks aren’t working.

The silver lining? Few stocks are flashing buy signals while the market is clearly weakening. It’s easier to stay out in that environment.

But stay engaged. A couple good days could revive the market rally and buoy stocks back into buy areas. So run your screens and update your watchlists. Look for stocks holding key support levels, such as the 21-day or 50-day lines. Some big recent winners are now pulling back to the 50-day/10-week lines.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Twitter at @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Cruise Line Stock #3 Royal Caribbean Cruise Lines

Royal Caribbean Cruises was founded in 1969 and since that time, has grown into five different brands that have 63 cruise ships in service. The company offers about 1,000 different destinations through its various routes for customers to enjoy.

Royal Caribbean is the second-largest cruise operator in the world and services six different continents. The company produced about $11 billion in annual revenue pre-COVID, and trades today with a market capitalization of $14.8 billion. Current projections put Royal Caribbeans revenue above pre-COVID levels for 2023.

Royal Caribbean reported first quarter earnings on May 5th, 2022, and results were very weak, but showed that the company is on the path to recovery. Adjusted earnings-per-share came to a loss of $4.57, which was nine cents below estimates. Revenue was up from essentially nothing in last years Q1 to $1.06 billion, but missed by $90 million against expectations.

However, the company noted it continues to make progress on its long recovery from the COVID stoppage, and provided bullish commentary on the remainder of 2022 and beyond.

Source: Investor infographic

Royal Caribbeans operating cash flow was positive in April of 2022, marking a turning point for the company that has struggled since the COVID outbreak. Management expects to be fully operational across 100% of the fleet by the start of the summer season of 2022, which is another key milestone on the path to recovery.

Don’t Miss: How To Find Last Minute Cruise Deals

Can You Get Rich From Dividend Stocks

Can an investor really get rich from dividends? The short answer is yes. With a high savings rate, robust investment returns, and a long enough time horizon, this will lead to surprising wealth in the long run. For many investors who are just starting out, this may seem like an unrealistic pipe dream.

Will Ccl Pay Dividends In 2021

I think it’s relatively unlikely that Carnival will pay dividends in 2021. The majority of their fleet is not yet operating, and the ships that are sailing are doing so with capacity limits in place. However, the news isn’t all bad. On their most recent conference call, they said this:

Just as positive, our cumulative advanced book position for the full year 2022 is ahead of a very strong 2019, which was at the high end of the historical range.

They also shared a number of anecdotes about how strong demand is once they announced sailings in Europe for this summer. It does seem logical that there would be pent-up demand for travel after consumers have been stuck at home. Given the strong demand for 2022 sailings, I think that earnings for that year should be very strong. It seems likely that they would then choose to re-start their dividend program at that time.

Recommended Reading: What Do I Need For Cruise To Bahamas

Where It Goes From Here

During the best of times, Carnival proved it could be a profitable company and a great dividend stock. But these are not the best of times. The company hasn’t been able to sail because of the pandemic. Consequently, it registered a massive net loss of over $10 billion in 2020, and its total debt increased by over $15 billion.

There’s no sugar-coating it — Carnival has a long road ahead to completely recover financially. First things first, it has to get back to sailing, and that’s still on hold at least until the end of June. And as long as ships are in port, Carnival continues to burn cash at a rate of $500 million to $600 million per month. In other words, the bleeding hasn’t stopped yet.

Once it’s sailing again, Carnival’s next hurdle will be filling its cruise ships. According to a recent survey by Cruise Lines International Association , 74% of people who have cruised before are looking forward to cruising again. However, other surveys suggest people are still waiting for the coronavirus to be more under control. And there’s no way to know how safe will be safe enough or if new strains of the virus will cause future setbacks. In short, it will take time before Carnival’s ships are full again.

Therefore, it looks like Carnival is at least a few years away from generating the revenue it was in 2019. And once it returns to profitability, its immediate concern will be whittling away at its debt load, not a dividend. This could also take some time.

When Will I Receive Carnival Corporation & Dividends

As a rule, investors receive dividends to a brokerage or bank account within the next 25 working days after the record date 21.02.2020 at latest! Thus, Carnival Corporation & s dividends should arrive no later than 0.5sDate.

Remember that after the cut-off date, Carnival Corporation & s stocks usually decrease by the amount of the dividend paid per share. When the company is doing well and the market is positive, Carnival Corporation & s dividend gap may be less than the dividend.

You May Like: What To Do In Curacao From Cruise Ship

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

- Gear advertisements and other marketing efforts towards your interests.

To learn more about how we handle and protect your data, visit our privacy center.

Search And View Past Cdp Responses

Welcome to the responses page. View all public corporate, city, states and regions responses to CDP questionnaires for current and previous years. For responses before 2010, please visit our Help Center and contact us via My Support. You will need to be signed in to our website access this. Once you are signed in, please return to the Help Center via the link at the top of the page.

We reserve all rights to all intellectual property rights on our site. Those works are protected by copyright laws and treaties around the world. You may not use, copy, reproduce or modify any content from our site without our permission. You may contact ushere to discuss the licenses that we offer for the use of our intellectual property.

Please or register to see responses.

Don’t Miss: Best European River Cruises 2021

Why Carnival Shares Could Go Down:

On the other hand, some current elements are more indicative of a decline in the price of this stock:

- : Carnival’s profits have of course been heavily impacted by the Covid-19 crisis and have suffered numerous losses over the past two years.

- Heavy dependence on the U.S. market: despite its efforts to internationalize its revenue sources, the company still derives the majority of its profits from the U.S. market, which represents a risk from an economic perspective.

- High exposure to foreign exchange: Because a significant portion of Carnival’s revenues are generated in currencies other than the U.S. dollar, profitability may be impacted by unfavourable exchange rates.

- A halt in dividend payments: Carnival has also stopped paying dividends to its shareholders in 2020 and 2021 and does not plan to pay dividends in 2022, which may deter some investors from buying the stock.

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

You May Like: Do River Cruises Have Casinos

What Made It Great

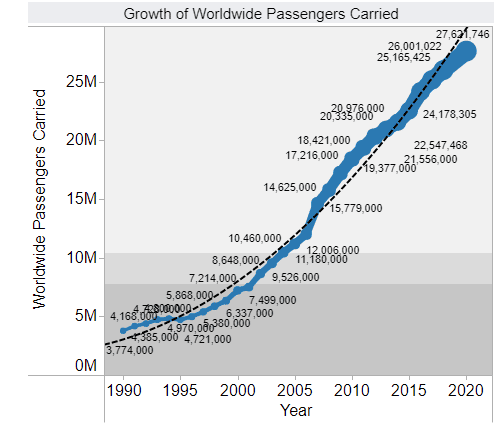

Before the coronavirus, the untapped cruise market was surprisingly enormous. For example, according to a 2016 survey by Allianz Global Assistance, 66% of people in the United States had never taken a cruise before. However, it seems most people enjoy cruises once they finally try one. Some estimates say that, historically, cruise ships are 50% filled by repeat cruisers. Moreover, Carnival was the market-share leader with an estimated 45% of the market.

Therefore, cruise lines had a steady stream of repeat customers and a large untapped market for new customers. This afforded management with a luxury: It could regularly order new cruise ships with reasonable certainty they could be filled. For example, toward the end of 2019, Carnival was scheduled to receive 17 cruise ships by 2025. Some would replace old ones others would increase its overall capacity.

From there it was pretty straightforward. By running a tight ship , Carnival management was able to achieve respectable net profit margins of 14.9%, 16.7%, and 14.4% in 2017, 2018, and 2019, respectively. And with a manageable long-term debt situation, management could reward shareholders with the profits. Some of this came in the form of its high-yield dividend. The company’s payout ratio was 46% in 2019 — a high percentage demonstrating management’s prioritization of the dividend. But it also rewarded shareholders by regularly buying back its own stock.

Image source: Getty Images.

Carnival Dividend Payout Ratio Related Terms

Thank you for viewing the detailed overview of Carnival’s Dividend Payout Ratio provided by GuruFocus.com. Please click on the following links to see related term pages.

Comparable CompaniesWebsiteExecutives

| 10 percent owner, other: See remarks | 1313 NORTH MARKET STREET WILMINGTON DE 19801 |

| 10 percent owner, other: See remarks | TWO ALHAMBRA PLAZA, SUITE 1040 CORAL GABLES FL 33134 |

| officer: EVP, Group Strategy & Corp. Op | 3655 NW 87 AVENUE MIAMI FL 33178 |

| TWO ALHAMBRA PLAZA SUITE 1040 CORAL GABLES FL 33134 |

Recommended Reading: What Cruise Line Goes To Turk And Caicos

Royal Caribbean Carnival See Cruising As Too Good A Value

Royal Caribbean and Carnival want to offer good value to consumers compared with land-based vacations — but there are limits to that effort. Weinstein commented on the matter during the cruise line’s third-quarter-earnings call.

“The issue is we are way too much of a value. We should not be priced at a significant discount to land, which is exactly the case today, anywhere from 25% to 50% based on itineraries,” he said.

Bayley told TheStreet that the problem is that it generally takes a year of selling to fill a ship, so the industry had to scramble after its long covid-related shutdown.

“But all of us were coming from very low load factors. And we were trying to get to our model number of 100% plus. And so, yeah, pricing was a challenge during that period,” he said.

He does believe that higher prices will return.

“I am more optimistic about pricing now than I’d been before. I think we’ve seen ourselves, our load factors are back, our bookings are solid, and our pricing is recovering,” Bayley said.

Carnival Liquidity And Capital Spending

One big reason for the company needing to conserve liquidity has been their significant capital spending plan. In the most recent quarter they spent $1.7 billion on shipbuilding capex, almost exactly double their spending in the year-ago quarter. That is very meaningful, and does hurt their liquidity. It will also help to offset the scrapping of a number of old ships . While the upfront costs are significant, the fleet will be on average newer and cheaper to operate, and also have 14% more berths per ship. That gives them the critical mass to operate additional amenities which drives bookings, and also provides operating leverage by dividing the fixed operating costs across more customers.

The new ships should help them improve their operating cash flow coming out of the pandemic, as should the cost cutting measures they undertook during their near death experience. The company’s debt has increased significantly, with net debt as of their most recent quarter of $19.8 billion. That is up considerably from their net debt at the end of fiscal 2019 of $11.0 billion.

Also Check: How Cold Is Alaska Cruise In July

Who Are Carnivals Partners

While Carnival faces strong competition from many actors in its industry, it also has some allies. Here are a few examples of recent partnerships:

- : the two companies are linked by a service contract via the subsidiary BluEdgetm, which provides preventive maintenance services for water mist fire protection systems on the fleet’s ships.

- Jabil Inc: This company has partnered with Carnival to manufacture the Princess Medallion in the Dominican Republic, a facility with more than 60,000 square feet of manufacturing space.

- Discover the World: Carnival recently named Discover the World as its new general sales agent in two Latin American markets with Argentina and Brazil. The company is one of the world’s leading sales organizations in the travel industry.

- China State Shipbuilding Corporation: The two companies have formed a joint venture called CSSC Carnival Cruise Shipping, which is majority-owned by the Chinese group. It has recently acquired two existing Costa ships and plans to build new ships in China.

- Shamal Holding: this partnership aims to make Dubai the leading maritime tourism hub in the region.

Be the first to hear about the best offers, promo codes and latest news.

Please consult service providers Terms & Conditions for more information. This site and the « HelloSafe.ca » trademark are operated under license by HelloSafe. All rights reserved.

What’s Happening With Carnival And Covid

Carnival suspended cruise operations in March 2020 after the COVID-19 pandemic struck. Carnival relaunched cruises from the U.S. on July 3, 2021, when the Carnival Vista departed from Galveston, Texas. It has since adopted detailed COVID-19 protocols. These include pre-cruise questionnaires and testing for vaccinated guests, and proof of vaccination required at terminals in advance of boarding.

In April 2022, Carnival said the week ending April 3 was the busiest for bookings in company history, up more than 10% from the prior record. The last of Carnival Cruise Line’s 23 ships returned to service on May 2.

As of April 2022, vaccine exemptions for select destinations in the Caribbean were available for a small number of children under 12, as well as teens and adults with medical conditions that preclude vaccination as documented by a medical provider. Unvaccinated guests must present a negative PCR COVID-19 test taken between 24 and 72 hours prior to embarkation in addition to taking an antigen test at embarkation and again within 24 hours of debarkation. Unvaccinated guests also must show proof of travel insurance coverage in some cases, and may only go ashore in ports of call when booked on a Carnival-sponsored tour.

You May Like: What Cruises Leave From Jacksonville Florida

Who Are Carnivals Competitors

Carnival is of course not the only one operating in this sector, although it is still the leader today. Here are its main competitors:

- MSC Cruises: this Geneva-based company belongs to the Mediterranean Shipping Company and owns the Italian tour operator Bluvacanze and the Italian ferry companies SNAV and Grandi Navi Veloci.

- Norwegian Cruise Line: this American cruise ship company is based in Florida and is Carnival’s main local competitor.

- Royal Caribbean Group: This company is a global cruise holding company that is also based in Florida. It is the world’s number two cruise company. It currently owns three cruise lines with Royal Caribbean International, Celebrity Cruises and Silversea Cruises.

- Expedia: this American company owns several online travel agencies and also operates in the cruise sector. It is therefore an indirect competitor of Carnival.

- Disney Cruise Line: This cruise line is a subsidiary of the Walt Disney Company. Its ships, the Disney Magic and the Disney Wonder, offer family cruises, one stop of which is a private island in the Bahamas also owned by the group.