Disney Cruise Vacation Protection Plan

Disney has Disney cruise insurance coverages that you can purchase through Disney that are underwritten by Transamerica Casualty Insurance Company. When Can You Buy Disney Cruise Vacation Protection Plan?You can purchase online, over the phone through DCL, or via your travel agent any time before your final payment is made. How Much Does Disney Cruise Vacation Protection Cost?8% of the per person sailing fare. Minimum per person cost is $29 maximum per person cost is $399.

Trip Delays & Interruptions: 37% Of Claims

Trip interruption is any situation that causes you to unexpectedly have to end your trip and return home.Trip delay is any time your trip has been delayed due to accident or a canceled flight or whatever.

What could cause a trip interruption or delay?

Natural Disaster

Floods, tornados, wildfires, whatever! Mandatory evacuations can really slow you down

Illness or injury

Getting sick or hurt is no fun. Especially on vacation!

Attack, Assault, Robbery

A vicious attack can interrupt or abruptly end a trip

Job or Money Problems

When travel workers go on strike, it can really mess up your plans

Trip Provider Bankruptcy

A travel supplier ceases operations due to financial default or bankruptcy

Dont Wait To Buy Your Insurance

You may be able to get complimentary bonus benefits, but it usually means buying your policy shortly after booking your cruise. For example, Travelex will cover you for a pre-existing condition , but only if you purchase the insurance within 21 days of making your initial trip payment. That limit applies to purchasing CFAR, as well. After the 21-day period, you can purchase only standard insurance. These restrictions are common and you should ask about them when looking to book a trip and are considering travel insurance.

Not sure which travel insurance plan you want? Dont worry, youre covered. Most plans will give you a free look period. With Travelex, thats 15 days, while InsureMyTrip notes that many of its partners give you 10 to 14 days.

» Learn more: COVID-19 travel insurance and refunds: What you need to know

Read Also: Cruise From Mobile Alabama To Cozumel

What Is Not Covered By Travel Insurance

Each travel insurance plan is unique, and some may protect everything you expect, but its important to consider which items arent typically covered. Some agencies may leave a few things out according to SmarterTravel.com, an expert travel advice company. For example, coverage for high-risk activities like scuba diving, snowboarding, or bungee jumping may be off the table, along with bad weather insurance and protection for lost items like passports, tickets, and glasses.

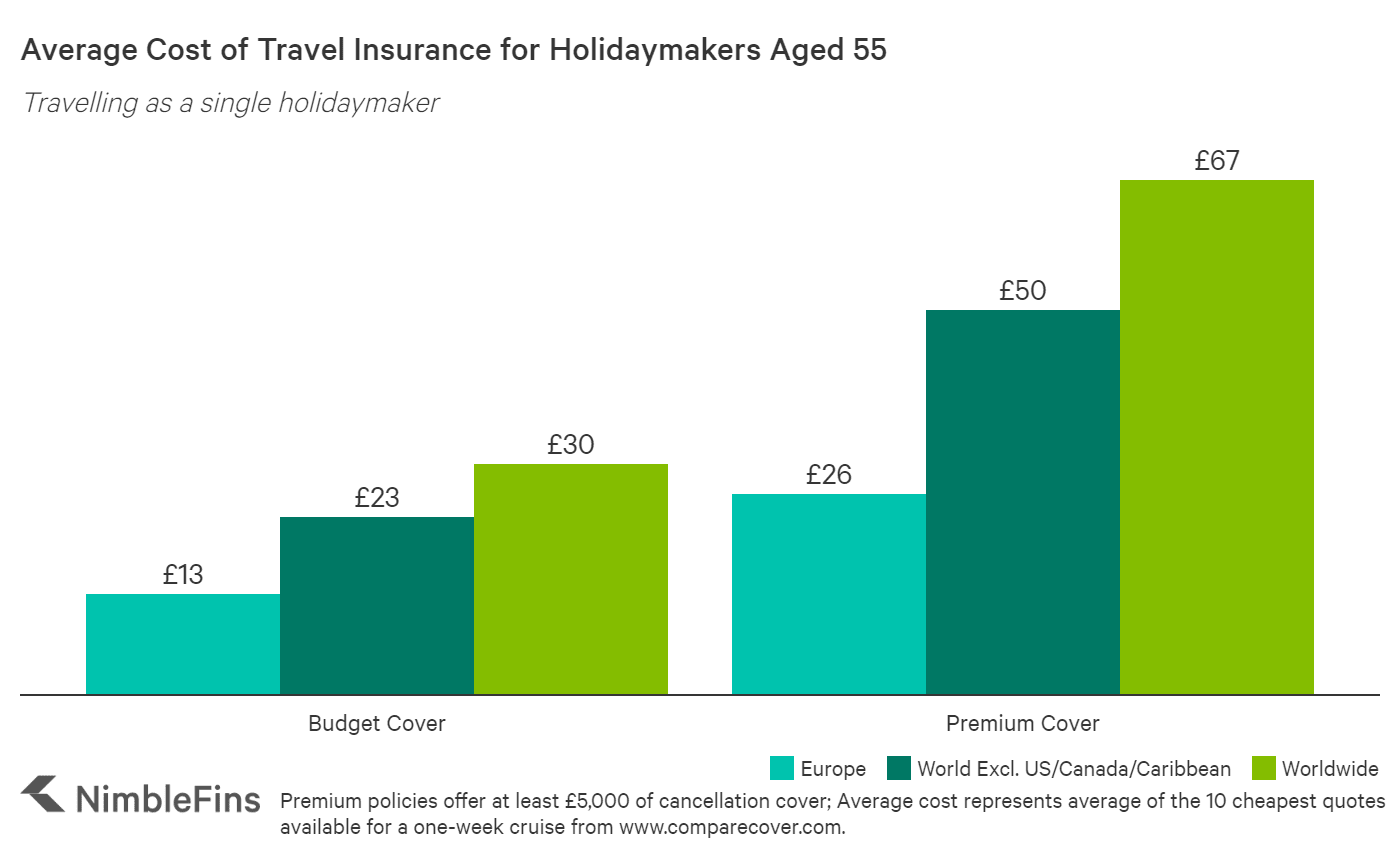

Cost Of Cruise Travel Insurance For 55 Year Olds

A 55 year old heading on a week-long cruise would pay a few quid more for holiday cover than a 45 year oldcheaper, budget options can be found for between £13 and £30 depending on destination. Premium plans with at least £5,000 of cancellation start from £26 for Europe, £50 for cover worldwide excluding USA, Canada and the Caribbean and £67 for cover all over the world.

| Cost of Cruise Cover | Cancellation Cover |

|---|---|

| £50 | £67 |

Couples pay about 2X as much as an individual. If you’re very budget conscious check and compare prices of two individual policies vs. a joint policy for a couple, as sometimes the cost of two separate policies comes in cheaper.

| Cost of Cruise Cover | Cancellation Cover |

|---|---|

| £131 |

Don’t Miss: Is Royal Seas Cruises A Scam

What Does Cruise Insurance Cover

Typically, cruise insurance will include coverages for:

- Emergency Medical

- Missed Connection

- Ship-to-Shore Coverage

Plans will vary as some of these coverages have limitations and eligibility requirements. We recommend speaking directly with a Customer Care agent to ensure your policy has the right coverages for you.

Cruise Travel Insurance For Trip Cancellation

If youre forced to cancel your cruise, how much of that prepaid trip cost could you get back? There are often cancellation penalties tied to travel purchases, especially cruise trips, and you could get a portion of your trip costs back or none at all. Those penalties tend to get more severe as the departure date gets closer. This is where Trip Cancellation coverage can help you.

Many things can happen between the time you book your cruise and the start of your vacation that could affect you or your traveling companions or family members and force you to cancel your tripsickness, job loss, and even flight cancellations due to adverse weather or an airline strike. Luckily, travel insurance is a small investment against the full cost of a cruise and Generali Global Assistance plans include Trip Cancellation coverage that can provide reimbursement for a canceled trip. This could be an especially important coverage if youre cruising during hurricane season.

Also Check: Cruises Leaving Mobile

Medical Expense: 13% Of Claims

If you get sick, hurt, or die while on your Disney Cruise, there can be a bevy of hefty costs. Here are just a few:

Hospitalization

Spending any amount of time in the hospital is expensive

Evacuation

If you get hurt in a remote spot, you’ll need to be transported to a hospital

Return of Remains

Care for the deceased after unexpected death

Sometimes You Need Travel Insurance For Cruises Because Life Happens

In the middle of your Caribbean journey from Nassau to Port Lucaya, you get word that your mother has fallen seriously ill. You need to get home fast, but how can you do it without breaking the bank? This is when Allianz Global Assistances travel insurance is your best friend. Call the 24-hour assistance hotline, and a travel expert can help you make arrangements to fly home from the ship’s next port of call. You can be reimbursed for up to 150 percent of the cost of the trip: both the unused portion of your cruise and the additional transportation costs for returning home early.

Recommended Reading: California Cruise To Hawaii

Trip Cancellation/interruption Insurance Coverage

The most basic cruise insurance policies cover you in case your trip is canceled or interrupted. These policies reimburse you for actual losses up to your coverage limits when:

- You must cancel due to a covered reason.

- You have to return home early due to a covered reason.

- There is a covered departure delay.

Reasons You Need Cruise Insurance

For many travelers who choose to go on cruises, the experience is far and away smooth sailing.1

But when something goes awry on a cruise vacation, from missing bags to missing your port of call, things can go south quickly. Consequently, travel insurance is as essential to pack as your favorite bathing suit and smartphone charger.

Otherwise, here are some of the reasons and scenarios that make purchasing travel insurance such an important step for getting prepared for your big cruise vacation.

Don’t Miss: Hawaiian Cruises From Los Angeles

Allianz Global Assistance Onetrip Prime Plan

Allianz Global Assistance offers several plans that vary in coverages.

The most popular plan, and the one that is the best for a Disney Cruise, is called âOneTrip Primeâ.

When Can You Buy Allianz Global Assistance’s “Prime Plan”?You can purchase up to 11pm eastern of the night before you begin your travels. If you have a pre-existing condition, you’ll want to purchase within 14 days of your first deposit, in order to meet an important condition for having pre-existing conditions covered.

How Much Does Allianz Global Assistance “Prime Plan” Cost?Around 2-6% of the total cost of your trip. My last quote was under 4% of my trip cost.

Tips For Buying The Best Cruise Insurance

Whether its your first cruise or one of many, having the right travel insurance is important. The highest numbers of claims from cruise passengers come under trip cancellation, travel medical expenses and trip interruption coverage, according to Jason Schreier, CEO of April Travel Protection.

Here are good starting points for coverage youll likely want in a cruise insurance plan:

Trip cancellation insurance: This reimburses you 100% for the pre-paid and non-refundable deposits you lose if you have to cancel for a reason covered by the policy.

Trip interruption coverage: This will reimburse you a percentage of the unused trip costs, such as 100%, 150% or 200%, if your trip is cut short because of illness, injury, death or other reasons.

Emergency medical expenses: This pays for medical expenses associated with injuries and illness you get while on the trip. The top travel insurance plans have $500,000 in travel medical insurance, but you might find $100,000 to be sufficient for a cruise. If youre a senior, good travel medical coverage is crucial.

U.S. health plans generally have very limited or no coverage outside the country. And Medicare doesnt cover medical care outside the U.S., with only very narrow exceptions.

Emergency medical evacuation coverage: This covers the costs to get you to the nearest adequate medical facility or even back home if its medically required.

Recommended Reading: Mobile Cruise Ship

What Is The Biggest Problem In Cambodia

There are many problems in Cambodia. Cambodia has a number of problems with its basic social environment. Cambodia has a very low GNP level, and it is a low-income country. Poor and needy ratio exceeds 30% of population, and the population growth rate is high, so poverty does not decrease as a result of population growth.

Add Our Cruise Cover To Your Policy For Added Protection

If youre off sailing the seven seas, make sure youre not left high and dry with Cruise Cover. Its there to help if you find yourself all at sea, need emergency treatment on-board or in-harbour or if you need to re-join the ship because an illness or lost passport keep you briefly ashore. Dont find yourself washed up if you miss the beginning of your trip due to breakdown or traffic, and make sure you look ship-shape and Bristol fashion if you need assistance to find alternative evening wear. Our Cruise Cover can be added for an additional premium.

Terms and conditions apply. Please see policy wording for full details.

Also Check: Cruise Ships With Solo Cabins

Baggage Loss Or Baggage Delay

Between airlines, ships, and ports-of-call there are plenty of opportunities for luggage to be delayed, lost in transit or stolen. Baggage loss coverage may help recover the costs of replacing lost items, or baggage delay coverage may help reimburse for the necessities purchased while waiting for bags. Having baggage can significantly decrease the stress of losing your belongings.

Travel Insurance For Cruises Can Make Medical Emergencies More Manageable

When youre soaking in rays on the Lido Deck with a good book in one hand and a fresh mango smoothie in the other, the last thing on your mind might be a medical emergency. Even if youre in perfect health, you can never predict when you might break an ankle or suffer a heart attack.

If you’re treated on board, prepare to receive a hefty medical bill. Your regular health insurance likely won’t cover you. Additionally, in the case of serious injury or illness, you dont want to be caught in a scenario in which you need to be airlifted off the ship to a medical facility, and youre left to pay for this out of pocket. According to the Centers for Disease Control , this can cost as much as $100,000 a cost that may need to be paid in advance and thats for the medical evacuation alone.3

That’s why travel insurance for cruises is more than a nice to have its an essential. Allianz Global Assistance offers plans with both an Emergency Transportation and Emergency Medical benefit, in addition to benefits such as Trip Cancellation, Trip Interruption and more.

Don’t Miss: What Is The Best Cruise Line For Single Seniors

Do Consider Whether You Want A Standard Or Cancel For Any Reason Policy

A standard policy has good protection and comes with a list of restrictions on whats covered. If you want to make sure that you are covered for any reason, whether thats a pandemic or a last-minute change in plans, look into a cancel for any reason add-on to your policy. A CFAR policy is just what the name sounds like. You can cancel your trip for any reason you want and are restricted only by the timing of your cancellation notice .

CFAR insurance isnt free though, and comes with a few conditions. First, it can cost 40%-50% more than a standard policy, and it generally wont cover 100% of your uncovered costs. Youll find that 50%-75% of coverage is more common.

Its also important to note that you cannot simply buy CFAR by itself. You must buy a travel insurance policy that is eligible for a CFAR add-on. Many insurance sites will include a CFAR filter in their search tool. You’ll also need to buy the policy within a certain time frame after purchasing your cruise, which will vary based on the insurance company.

» Learn more:Cancel For Any Reason travel insurance explained

Do You Need Special Insurance For A Cruise

Due to the unique nature of traveling by cruise ship, travel insurance is strongly recommended for all travelers. Depending on the plan, cruise travel insurance can protect against missed connections, an emergency evacuation, unexpected medical issues, baggage loss, and more.

As of July 2021, some cruise lines now recommend or require unvaccinated American passengers to show proof of valid travel insurance as a condition of boarding. InsureMyTrip offers cruise travel insurance plans that meet and/or exceed such requirements.

Read Also: Cruises From Mobile Alabama 2016

How To Find Cheap Cruise Insurance

Getting cheap cruise insurance sounds great, but its more important to make sure you buy the right cruise travel insurance for your needs. If you dont have enough cover, and something goes wrong, you could find yourself out of pocket.

To get the cheapest possible deal which still meets your needs, try these 8 ways to cut the cost of your travel insurance.

Cruise Insurance Medical Coverage Vs Your Regular Health Insurance Plan

Travelers often have health insurance back home, so purchasing cruise insurance with medical benefits may seem like a waste of money. However, many health insurance policies don’t cover non-emergency procedures or may treat claims as “out of network.”For example, Aetna covers emergency treatments 24/7 anywhere in the world, but nonemergency conditions may not be covered. Out-of-network claims generally mean that you’ll be paying more out of pocket.

Even if your insurance will cover you internationally or aboard a cruise, the doctor or hospital treating you may not accept it. They could even demand payment upfront before beginning treatment.

Cruise ships are required to have a doctor and hospital facility on board in the event someone is injured or becomes ill. However, these infirmaries are typically designed to stabilize patients and make them as comfortable as possible until the ship reaches its final destination or the nearest port of call.

Depending on your condition, you may need to depart the cruise to continue treatment at a local hospital, or be medically evacuated back home. Medical evacuations are very costly and without insurance that covers them, a cruise-goer would have to pay for those bills out of pocket.

Purchasing a cruise insurance policy gives travelers peace of mind and reduced financial risk in case they become ill or injured during their vacation.

Don’t Miss: Are Cruises Leaving From Puerto Rico

Average Travel Insurance Cost By Age

In addition to the types of coverage and the claim limits, a persons age has a substantial impact on the cost of travel insurance. No matter the type of policy someone buys, the price increases dramatically the older they are. Our analysis below showed that premiums remained relatively flat for travelers age 1 through 30, but then the cost begins to climb. The most drastic increases occur between ages 60 and 80. We attempted to gather quotes for travelers as old as 100, 105 and 110, but no companies offered quotes for our sample traveler of those ages.

| Age |

|---|

How To Be A Better Prepared Cruise Voyager

Here are other tips for cruise passengers from Schreier at April Travel Protection:

- Check the expiration dates on your passports and be aware of possible travel insurance requirements in other countries well before you leave.

- Get an international plan from your cell phone/data provider for the time youll be away. The cost for calls and data through the cruise lines are exorbitant, and this will allow you to operate freely when in ports, says Schreier.

- Make sure youre up to speed on the entry requirements for the countries youll be visiting. This often includes vaccinations or inoculations required for certain places. You wont be allowed off the ship if you dont meet the countrys requirements, or in some cases you wont be allowed on the ship if youre missing certain requirements.

- Leave the water bottles that arent filled with water at home. Most cruise lines are aware of this trick and will confiscate your liquid if its flammable, says Schreier.

You May Like: Norfolk Port Cruises

Does The Best Cruise Insurance Uk Wide Cover Me For Every Cruise Destination

Most cruise travel insurance policies cover any cruise destination.

This usually includes the Mediterranean, Baltic or Caribbean. But its important to check with your insurer or look at your policy before you go on holiday. You need to make sure that there arent any exclusions on your policy for your intended destinations.

The other thing to check is whether the UK Governments Foreign and Commonwealth Office has issued any advice on your destinations. If the FCO advises that its unsafe to travel, then travelling anyway could invalidate your cruise travel insurance.