Does Normal Travel Insurance Cover Cruises

Cruises are a great way to see the world, but theyre different to traditional fly and stop holidays. Certain things that happen at sea usually arent covered by a standard policy, which is what makes Cruise travel insurance a useful add-on if youre heading out on the open water.

Cruise travel insurance is specifically designed for those holidaying on a ship. It accounts for unique issues, such as missing the cruises departure because your car breaks down on route to the port or being confined to your cabin through illness. It even considers the fact that youre moving from port to port, rather than staying in one place the planned itinerary could change, and you may miss a port or not get chance to do an excursion you booked. With standard travel insurance, you wouldnt be covered for these things. But, if you take out travel insurance with Cruise cover, youre protected so you can just enjoy your holiday.

Cruise Travel Insurance For Pre

At Holiday Extras we can cover a wide range of pre-existing medical conditions with our travel insurance packages and a policy for your cruise is no exception. We cover the majority of pre-existing medical conditions, and ALL medical conditions will be considered. When booking, you will be guided through the process of getting declaring any medical conditions you may have when you call our customer service team, or you can declare the conditions of each individual named on the policy when you buy online via our website. The process is quick and simple both online and via our contact centre. See below for more information.

You Have An Ehic Do You Still Need Specialist Cruise Travel Insurance

Yes you will still require cruise travel insurance. The EHIC card will ensure you are entitled to the same level of treatment as a citizen of that country.

However, it does not cover cancellation or curtailment and will not cover private medical costs if you are taken to a private hospital. It also does not cover medical evacuation costs or provide repatriation cover if you need to be returned to the UK.

Recommended Reading: Mobile Al Cruise Schedule 2020

What Does Cruise Insurance Cover

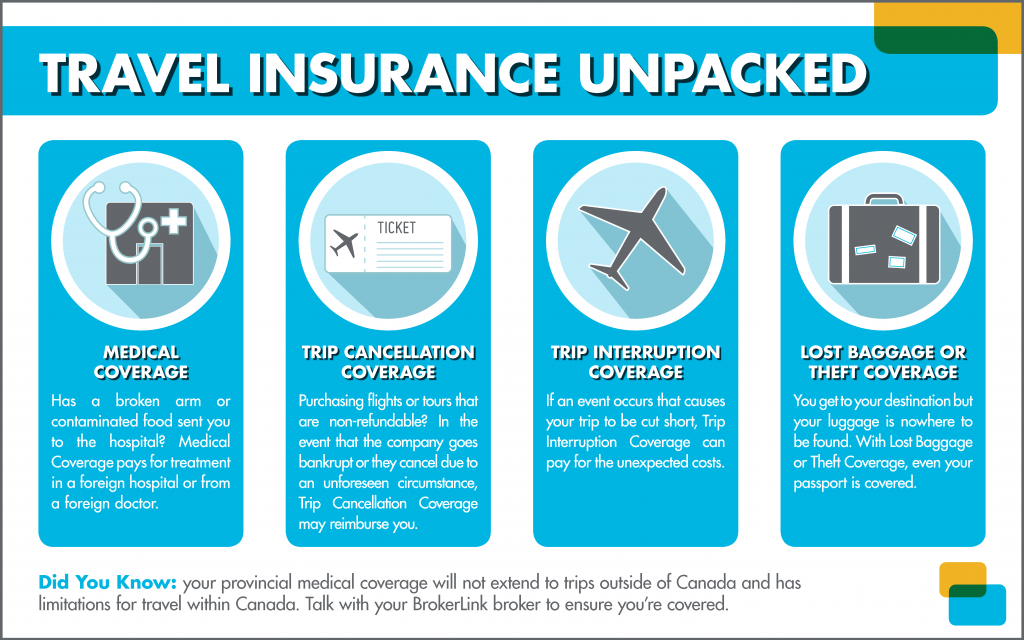

The best cruise insurance policies should cover you for the following:

Cabin confinement: providing a pay-out up to a set limit if youre confined to your cabin by the ships medical officer for medical reasons

Missed port departure: if you miss the departure and have to pay for accommodation or travel expenses to get to the next dock, youll be compensated providing, that is, the departure was due to public transport delays, a vehicle accident or breakdown, a strike, industrial action or adverse weather

Unused excursions: covering the cost of any pre-booked excursions you cannot use as a result of cabin confinement due to illness or injury

Cruise interruption: if you need hospital treatment, this covers any travel expenses you have to pay to re-join the cruise at a later stage

Emergency medical treatment: this includes being airlifted to hospital

Lost and stolen luggage: covering the cost of any lost, stolen or delayed luggage during your trip

Cancellation and curtailment: providing cover should you need to cancel or cut your trip short. Note that you can usually only claim for reasons such as illness, redundancy, a stolen passport, or a court case. Most cruise insurance includes cover for cancellation if you fall ill with Covid-19 prior to departure or are required to self-isolate and miss embarkation, but check youre happy with the cover provided before you buy

Activities: covering you for any activities you plan to take part in on your holiday.

How Is The Coronavirus Affecting Travel Insurance

When it comes to coronavirus, its important to know that circumstances like epidemics and pandemics are not typically listed as covered events under most standard cancellation policies. Also worth noting: Preemptively canceling a trip out of fear for your health and safety is never part of a standard policy. Accordingly, while some insurers honored claims associated with the onset of the epidemic, almost none are paying out trip cancellation claims for travel or policies booked after late January . This is owed to the rationale that once the outbreak became a known event, risk is assumed by the would-be travelers who book.

However, there are now some providers who do not consider contracting the virus as foreseen, even during a global pandemic like the coronavirus outbreak, says Kasara Barto, public relations manager for Squaremouth. In this case, trip cancellation benefits can still apply if a traveler contracts the virus or is physically quarantined and unable to travel as planned.”

Economic-woe scenarios, like having to cancel if you are laid off from your job, or if a travel supplier should declare bankruptcy, are typically covered under standard plans. Squaremouth notes, however, that coronavirus-prompted impacts like travel bans and border closures are not usually covered by standard policies, nor are cases of cruise lines canceling a scheduled sailing .

Also Check: Hurricane Season In Bahamas For Cruises

Cruise Planning: Buying Travel Insurance For Covid

Cruise travel insurance is nothing new. Unlike normal travel insurance, which covers basic hiccups like weather-related flight delays and lost luggage, cruise travel insurance ups the ante by protecting passengers when it comes to missed port departures, itinerary changes and other cruise-specific issues.

In today’s world, plans have been optimized to cover passengers for problems related to COVID-19. Among this extra layer of protection are trip cancellations and medical expenses — typically higher for cruises, where a medivac might be necessary to get to a hospital.

Cruise travel insurance can be purchased directly through the cruise line or via an insurance company like Allianz, Berkshire Hathaway and John Hancock.

Travel Insurance Primer For Cruise Travelers

The last thing most of us think about when we plan a cruise is the list of elements that can go wrong before and during our vacation. But there are definite reasons why you should consider travel insurance for your cruise.

Flight delays caused by weather or a mechanical problem can keep us from arriving to our embarkation port in time. The airline can lose our checked bags. We can get sick before we board or, even worse, mid-cruise. We might make a boneheaded move in a port of call and miss the ship. Plus, a host of other general issues can scuttle a vacation, such as the illness or death of a family member, cancellation of plans by a travel companion, job loss, airline delays and lost baggage.

Today of course the biggest concern for many travelers is COVID-19 insurance — we have a separate article which cover that.

Those reasons and so many others are why cruisers seek insurance coverage — and why we recommend it. It provides that extra bit of calm and control we all crave. More importantly, it prevents you from losing money due to unforeseen circumstances and travel emergencies, and insurance fees are typically just a small percentage of your vacation expenditure.

Don’t Miss: Best Job On Cruise Ship

Cruise Insurance Protects Your Investment

For most of us, a cruise represents a considerable investment. Worrying that a missed flight or unforeseen emergency could not only ruin your vacation but could also cause you to lose your whole investment makes it hard to relax and have a good time. Knowing that you and your family are protected from loss will let you relax and enjoy your trip with an easy mind.

It is important to remember that cruise insurance policies vary in the amount of coverage they provide. Before purchasing travel insurance for a cruise, make sure you are aware of exactly what is covered. If you are still not sure if cruise insurance is worth it, call CruiseExperts.com at 1-888-804-CRUISE. Our travel advisors will answer any questions you have about cruise insurance, and help you find a policy to protect your cruise investment. Dont forget to like us on and join our InnerCircle for exclusive offers and cruise news you can use. Also, check out our new Resource Center, where you can receive expert knowledge from us before your next cruise or cruisetour!

Does Trip Cancellation Or Trip Interruption Insurance Cover Covid

At the beginning of the crisis, several insurance companies announced that COVID-19 is a known event and, therefore, uninsurable under their insurance policies that cover trip cancellation or interruption.

Therefore, this means that your travel expenses will not be reimbursed if you purchased a trip or your insurance after your insurance company announced that it no longer covers travel cancellations or interruptions related to COVID-19.

If you have any doubts regarding your coverage, contact your travel insurance company.

Don’t Miss: Are Alaskan Cruises Worth It

Can I Get Travel Insurance After I Book My Cruise

A common question we receive is “how late can I purchase my travel insurance?” We recommend purchasing early, ideally after making your first payment towards your trip. Some benefits are time-sensitive, such as coverage for pre-existing medical conditions or the optional Cancel for Any Reason benefit. And while some plans offer post-departure benefits or can be purchased last minute, we advise not to wait to start comparing travel insurance plans.

Why Is Coronavirus Dangerous

The coronavirus, sometimes written as “corona virus,” is a highly contagious, pneumonia-causing illness that infects the respiratory system. Symptoms can include a fever and cough that may progress to a severe pneumonia, which causes shortness of breath and difficulties breathing. Symptoms of this disease may appear in as few as 2 days or as long as 14 days after exposure. The situation is evolving as more information becomes available. For the latest information, refer to the U.S. Center for Disease Control and Prevention website.

Recommended Reading: Caribbean Cruise Line Bahamas Celebration

Medical Evacuation And Repatriation Of Remains

A Medical Evacuation & Repatriation of Remains benefit covers your physician-ordered, emergency air or ground transportation from a hospital or emergency care facility that is ill-equipped to treat you to the nearest hospital that can provide adequate care.

This benefit may also cover travel expenses home for your travel companion if you are expected to be hospitalized for 24 hours or more. If you are traveling with a minor, you could also get coverage for their necessary transportation, accommodations, and meals while you are being treated.

In the unfortunate event that you pass away during your trip, this benefit can also cover repatriation expenses to return you to your home.

Example of the Medical Evacuation & Repatriation of Remains Benefit in Use

You become seriously ill during your cruise. You visit your cruise ship’s medical facility in the hope of being treated onboard, but it cannot provide the care you need. You must be transported to the nearest on-shore hospital that has sufficient equipment and the necessary specialists to treat you.

Whats A European Health Insurance Card

If you need medical treatment while cruising in Europe, the European Health Insurance Card means you can get medical treatment at the same cost as the locals.

After Brexit, and the UK officially left the EU with a deal in place, things have changed. You wont be able to apply for an EHIC anymore, but, if you have one already, issued before the end of 2020, then itll still be valid until the expiry date.

However, the UK government has introduced a replacement called the Global Health Insurance Card . If you dont have an EHIC, or once yours expires, you can apply for a GHIC here, and it should arrive within 10 days. The GHIC will offer the same cover as the EHIC did in EU countries.

The EHIC/GHIC isnt a substitute for travel cover it wont pay for getting you home or other costs linked to a medical emergency. Be aware, that its valid in most but not all European countries. However, if youre going on a cruise outside of the EU, theres no EHIC/GHIC so it can be expensive to get medical support.

You May Like: Cruise Out Of Virginia Beach

Other Plan Benefits To Look For

The plans listed above include benefits beyond trip cancellation and medical coverage. Check out the details to make sure youre getting other benefits you want, too. For example, the Cat 70 plan that scored among the highest in our rankings also provides reimbursement for:

- Trip cancellation due to injuries, weather, hurricanes and terrorism

- Missed connections

- Baggage and personal items

What Does Travel Insurance On Your Cruise Cover

One misconception about travel insurance is that it’s only necessary for travelers in ill health, those who pack valuable items in their suitcases or those who plan wildly expensive trips. It’s important to recognize that travel insurance policies can bail us out of a multitude of quagmires. For example:

Also Check: Cruise Out Of Mobile

What Does Travel Insurance Cover For A Cruise Six Key Benefits

Its smart to buy travel insurance for every trip you take, but its especially important for a cruise. Thats because when youre in the middle of the ocean, small problems can suddenly turn into major disasters.

So what does travel insurance cover when youre on a cruise? Well break it down for you. Make sure you review your insurance plan carefully before you buy, because not all plans offer the same coverage.

And if your next cruise is on the horizon, dont wait to buy insurance! The earlier you purchase a plan, the longer your coverage window. With a broad range of benefits, the One Trip Prime Planis our most popular plan for vacations. Compare all our plans.

Where To Buy Cruise Travel Insurance

While cruise lines usually offer their own insurance policies, experts advise looking instead to an independent, third-party insurer. Travel insurance policies from independent insurers tend to be more comprehensive than those you might purchase through a cruise line, McDaniel says. Cruise line insurance is usually secondary coverage, meaning youll first need to file through any private insurance policies that you have before your travel insurance will kick in. This could mean needing to pay out-of-pocket to start.

Adds Page: The advantage of purchasing a comprehensive travel insurance policy through an insurance provider like Travel Guard is that the comprehensive plans may offer additional benefits, such as emergency medical evacuation, which may not be available under protection plans offered through cruise lines.

In addition, cruise line insurance can be more limited than you might expect. Travelers who purchase the cruise lines policy can only insure expenses purchased directly through that cruise line,” says Jenna Hummer, former director of public relations for Squaremouth. “Any outside airfare or expenses would be forfeited in the event of a cancellation.

You can pick up a policy from your travel agent directly through a reputed individual insurance provider , or via an insurance comparison site that lets you compare plans from various insurers .

Don’t Miss: Msc Dress Code

How Much Do You Need To Pay To Get Travel Insurance Cover For A Cruise

The final cost of a standard policy depends on your overall vacation expenses. It is generally 5 to 10 percent of the total amount you pay beforehand. It also includes a non-refundable trip cost. These estimates are according to the data that Squaremouth provides. However, the premium varies depending on the policy and provider. There are primary factors for it. Your total trip cost, age of the travelers, and duration of travel. It is obvious for old people to pay more for the same policy as compared to younger ones.

If you want benefits like cancel for any reason then you have to pay a higher premium. It certainly increases by 40 percent over the cost of a standard policy. Also, the coverage wont be more than 75 percent of the total trip.

Coronavirus And Travel Insurance

As were all aware, Coronavirus had a huge impact on travel, with the cancellation of multiple flights, holidays, events and in particular cruises.

So what does that mean for your cruise holiday and coverage? Its important to know what cover is included on your policy before you book a trip. You can find out what is and isn’t covered here.

Well cover medical and repatriation costs if you become unwell with COVID-19, as well as trip cancellations if you or a travelling partner falls ill with coronavirus. We also provide cover for emergency repatriation costs if the Foreign, Commonwealth and Development Office imposes restrictions that mean you need to come home.

Also Check: Cape Canaveral Cruise Parking

Annual Fee For Medical Evacuation Family Coverage

MedJetAssist offers annual policies for individuals and families. Residents of the United States, Canada and Mexico are eligible for these plans, which cover medical evacuation and repatriation, both domestically and when traveling outside of the country of residence.

The company ensures that a jet will be available whenever the insured needs it policy members who are hospitalized out of the country can choose to be transported to any hospital of their choice around the world. Annual family memberships start at $399 for international and domestic travel , while short-term memberships start at $184.

Is There A Vaccine For The Coronavirus

Through Operation Warp Speed, the federal government has been working to make one or more COVID-19 vaccines available as soon as possible. In December of 2020, the Pfizer-BioNTech COVID-19 Vaccine and Moderna COVID-19 Vaccine were In February 2021, Johnson & Johnsons Janssen COVID-19 vaccine was added to that list. As this situation remains fluid, please refer to the U.S. Center for Disease Control and Prevention website for the most up to date information on vaccine development and approval.

You May Like: Carnival Cruise Deals Mobile Al