When Should I Buy Travel Insurance

A common question we are asked is, When should I buy travel insurance? Our customers know a plan is important but arent sure of the travel insurance sweet spot. Do they purchase before a trip is booked? The same day it’s scheduled? After the trip is paid off? Before or after they depart?

There are only three “rules” about when to buy a travel insurance plan:

So, in reviewing the three rules, you may still be a little confused on that travel insurance sweet spot. We tell travelers to prepare early. As soon as you book and make an initial payment on your trip, start comparing travel insurance plans.

The Best Time To Buy Travel Insurance Is Immediately After Youve Completed Your Travel Arrangements

Lets say youre planning a Rhine river cruise to see the famous Christmas markets of Germany and France. Youll need to book the cruise itself, any excursions you plan to take, your airfare and your hotel for two extra days in Zurich, post-cruise. Once youve gotten all those arrangements nailed down, youll know your total pre-paid trip costs and thats the perfect time to purchase travel insurance.

Why? You need to know your total costs to get an accurate quote, if youre purchasing travel insurance with trip cancellation/trip interruption benefits. That way, your entire travel investment can be protected.

Its smart to buy travel insurance immediately after booking for two reasons. One: You wont forget! Far too many travelers postpone buying travel insurance and then realize, too late, that they neglected to buy it at all.

And two: the earlier you buy insurance, the bigger your coverage window. Trip cancellation benefits begin on your plans effective date, as long as we receive your premium before you cancel your trip or make a claim. The earlier you purchase insurance, the sooner youll be protected.

So if youve already made all your travel arrangements, dont delay! Get a quote for travel insurance right now.

Can’t I Get Travel Insurance Through My Credit Card

To attract customers, many credit cards offer extras, including travel insurance.

The insurance is typically activated by using your credit card to pay for part of your trip.

While credit-card travel insurance is often marketed as free, the cost of it is often included in the credit cards fees, says the Australian Securities and Investments Commission .

Also, there can be significant differences in the level of cover provided by specialist travel insurers and credit card companies.

For more information, read ASICs Credit card travel insurance web page.

Recommended Reading: Best Cruise For Young Adults

How Much Does Carnival Vacation Protection Plan Cost

The prices for the vacation protection plan varies with the cruise fare paid. Averagely the vacation protection plan will cost you between 10-15% of your total cruise fare less tax, fees, and gratuities deductibles. See carnival insurance prices in the table below. Note, however, that the prices are subject to change at any time.

You should consult Carnival for confirmation when planning your trip. Individual cruise fare paid Price for vacation protection:

$0 $400 $49

Can I Cancel A Carnival Cruise Without Incurring A Penalty

According to Carnivals site, if you cancel a trip before you make the full vacation payment there will be no charges incurred. However, if you had booked a promotional trip that has a non-refundable policy, there will be charges incurred.

Cancellation charges or penalties will depend on the length of your trip for example,

For cruises that are less than 5 days, you have up to 60 days to make a final payment before departure.

For cruises which are 6-9 days long, you have up to 75 days to make the final payment before departure.

For cruises that are 10 plus days, you will have up to 90 days to make the final payment before departure.

To avoid being penalized, you have to cancel the trip before the given days elapse provided you have not finished paying for your vacation cruise.

There are some promotions on Carnival that have a non-refundable policy such as the early saver, super saver, and pack and go travel packages. The deposits made for these packages are non-refundable after booking.

Once your booking enters into the cancellation penalty period, note that the penalties will increase the more the departure approaches.

Read Also: Marriott Cruise Ship

For Travel Arrangements The 24/7 Cover Does The Following:

- It takes care of last minute flight arrangements.

- It manages hotel reservations for you.

- It tracks lost, stolen or delayed baggage.

- It makes rental car reservations.

- It coordinates travel for your visitors to come and be with you in the hospital in case of sickness or injury.

- It takes care of your childrens travel arrangement in case of your sickness or death.

- It assists you to locate the nearest embassy.

- It assists you to perform cash transfers and also assists you with bail bonds.

The 24/7 assistance package helps you with pre-cruise information such as destination guides, currency exchange, health, safety and weather advisories.

This package also offers you assistance with lost passports and travel documents, email communication, phone messaging communication to your family and friends, and emergency relay messages. It assists you with language translation and interpretation services as well.

In the medical front, it assists you with medical transportation, manages medical cases, locates and dispatches doctors or specialists, and it also provides you with worldwide medical information, replacement of eyewear, prescription drugs, and dental appliances.

In the emergency front, they offer emergency medical, dental, legal, family travel arrangement assistance.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Cheap Family Cruise Vacation Packages

What Is Carnivals Coverage Scope

Carnival cruise insurance coverage begins when your final payment for the insurance cover is received by the cruise line.

In the cases of trip cancellation and interruption, the coverage time is different. For trip cancellation, the coverage begins from the time the full payment of the cover is made. For trip interruption cancellation the coverage starts from the scheduled departure date.

Your vacation protection plan coverage ends the moment the cruise is completed or when you arrive at your return destination. It also ends the moment you cancel the vacation.

What To Do If You Booked A Trip And Have Insurance But Your Policy Doesnt Include Cfar Clause

If you purchased a comprehensive travel insurance plan for an upcoming trip but didnt add CFAR coverage, just be aware that your options for coronavirus-related cancellations are more limited. While CFAR is the only cancellation option to cover fear of travel due to the coronavirus pandemic, some comprehensive policies still offer coverage for other COVID-19-related concerns. This may include:

- Coverage for common concerns like cancellation due to diagnosed illness before traveling

- Emergency medical care from a doctor or hospital if you become ill while traveling

- Accommodation coverage if quarantined at your destination

Always be sure to review your policy carefully to understand the exclusions but note that, without CFAR coverage, canceling a trip simply because youre afraid of contracting COVID-19 will likely not result in a successful claim under standard, comprehensive travel insurance plans.

Also Check: Best Time Alaska Cruise

What Is Carnival Vacation Protection

Carnival Cruise Line partnered with Transamerica casualty insurance company and came up with an insurance cover called Carnival Vacation Protection plan. Whichs main aim is to protect you, a traveling companion and a family member together with your belongings and your financial investment when vacationing with them.

Faqs About Carnivals Vacation Package

Cruise insurance can be tricky to figure out, thats why weve decided to cover some of the most common questions here regarding Carnivals policy here.

What happens if I get sick and cant go on my cruise?This is exactly what the cruise insurance was made for. If you, your traveling partner, or immediate family gets sick and cant make your cruise, then Carnivals policy will reimburse you 100% of what you paid.

Am I covered if I am on an excursion and get hurt?Yes. Should you have an accident, you are reimbursed up to $10,000 in medical expenses. Keep in mind that your regular health insurance should be used first, before payment from the Carnival Vacation Protection plan.

Can I get my money back if I cancel a cruise without insurance?In some cases yes. If you decide to cancel a cruise well in advance, you may be eligible for a refund of what youve paid, even if you dont have cruise insurance. See the schedule earlier in this article for what sort of refund you are eligible for.

Notice: We are not insurance professionals. Whats mentioned above is our interpretation based on reading the policy. There could be errors or misunderstandings. If you have specific questions, refer to the Carnival website or call the program administrator at 1-800-331-2796.

You May Like: Turk And Caicos Cruise Port

What Does Cruise Insurance Cover

All our insurance plans cover medical emergencies, trip cancellation, trip interruption, medical evacuation, and lost, damaged, or stolen luggage.* WaveCare then adds to these standard coverages a cruise disablement fixed benefit a payment for your inconvenience if your cruise is disabled and unable to arrive in port.

Supplement Your Credit Card Trip Protection Benefits

Rewards credit cards like the Chase Sapphire Preferred and the Sapphire Reserve come with complimentary trip protection benefits. These benefits reimburse non-refundable travel purchases, cover incidental delay-related expenses, and even offer primary rental car collision damage waiver protection.

While these trip protection benefits are great and cover common trip cancellation claims, you may still want travel insurance for these benefits:

- Emergency Medical Visits and Transportation

- Pre-Existing Conditions

- Extreme Sports

Each destination has different activities and risks. Travel insurance helps protect against the unexpected.

A primary incentive to get travel insurance can be for the emergency medical assistance. Without these benefits, you can easily spend over $10,000 out-of-pocket for treatment and transportation expenses. This can be especially true if you’re vacationing internationally or in a remote area, where medical costs can be higher than usual.

Also Check: Best Time Of Year To Cruise The Mediterranean

When To Purchase Coverage For Canadian Customers

Only a few travel insurance companies on InsureMyTrip offer plans that cover medical emergencies and evacuation as well as cancellation, delay, and baggage. Some companies offer cancellation-only plans as well. All plans available on InsureMyTrip must be purchased before you leave Canada, you cannot purchase any of these plans once you have departed. Importantly, you cannot purchase coverage for only a portion of your trip you must fully insure it. If you do not, then the plan would be considered invalid and not provide coverage.

Do Know Whats Covered

Is a job loss covered? How about a death in the family? Be sure to read the terms and conditions of the policy, particularly the schedule of benefits and coverage details, which serve as a summary.

For example, is a COVID-19 related issue covered? The answer depends on when you bought your policy, since pandemics and epidemics are often specifically excluded. So if you bought the policy after your insurance company declared COVID-19 to be a pandemic, you may not be covered for COVID-19-related reasons. There are also several companies now including COVID-19 related illnesses as covered reasons but fear of traveling doesnt qualify. Bottom line: Know what is covered and what isnt.

» Learn more: How to find the best travel insurance

You May Like: Jetport Park & Ride Center

Carnival Vacation Protection Prices

You can buy Vacation Protection when you book your ticket, and its the best time to do so if you plan to purchase the plan as it gives you the longest stretch of coverage.

Prices vary depending on the price of your cruise fare, but we found a range from between $49 per person for the least expensive cruises, up to $189 per person for pricier trips. In general, expect the cost to run about 10-15% of your cruise fare, before taxes, fees, gratuities or other expenses. It can sometimes be more or less that this estimate.

If you do decide to purchase the package, it does come with a 10-day review period. If for any reason you change your mind about coverage, then you can cancel within 10 days for a full refund, assuming you havent made a claim.

Take Advantage Of Time

The good news about being in a hurry is that, since youll be purchasing your last-minute travel insurance soon after youve made your first payment on the trip, you may be eligible for some very helpful benefits that arent offered to travelers who wait. Items like pre-existing conditions waivers offer valuable coverage, but are only available if you buy travel insurance within 10-21 days of your initial trip payment. Thats good news for last-minute travelers.

While some plans only offering post-departure benefits can be purchased last minute , we advise not to wait when considering plans with pre-departure benefits like a comprehensive plan.

Recommended Reading: How Much Does The Average Cruise Ship Cost

Berkshire Hathaway Travel Protection Cruise Insurance = Cruising Peace Of Mind

A cruise is perfect for leaving your cares and worries behind. With cruise trip insurance from Berkshire Hathaway Travel Protection, you dont have to worry about:

- Having to suddenly cancel your trip because of a medical emergency

- Catching up with your cruise after a flight delay or missed connection

- Figuring out what to wear because your luggage is lost, damaged, or delayed

How Much Does Cancel

CFAR coverage is sounding pretty good as a way to hedge bets against the continued uncertainty of the coronavirus pandemic. But, how much are you going to have to dig into your wallet to pay for it? The fee for this add-on is typically calculated as a percentage of the price of the standard insurance policy you select.

Standard comprehensive plans can cost about 4-10% of the total cost of the insured trip, and CFAR can be an additional 40-60% on top of the standard plan .

Consider the following illustrative example for a $5,000 trip with two 50-year-old travelers to Aruba:

- A standard, comprehensive plan might cost around $250 which is 5% of the total trip cost.

- A comprehensive plan with the CFAR upgrade included might cost around $375 which is the price of the standard plan plus an additional 50% .

However, please note that all plan costs can differ based on individual quote details.

Also Check: Average Cruise Prices

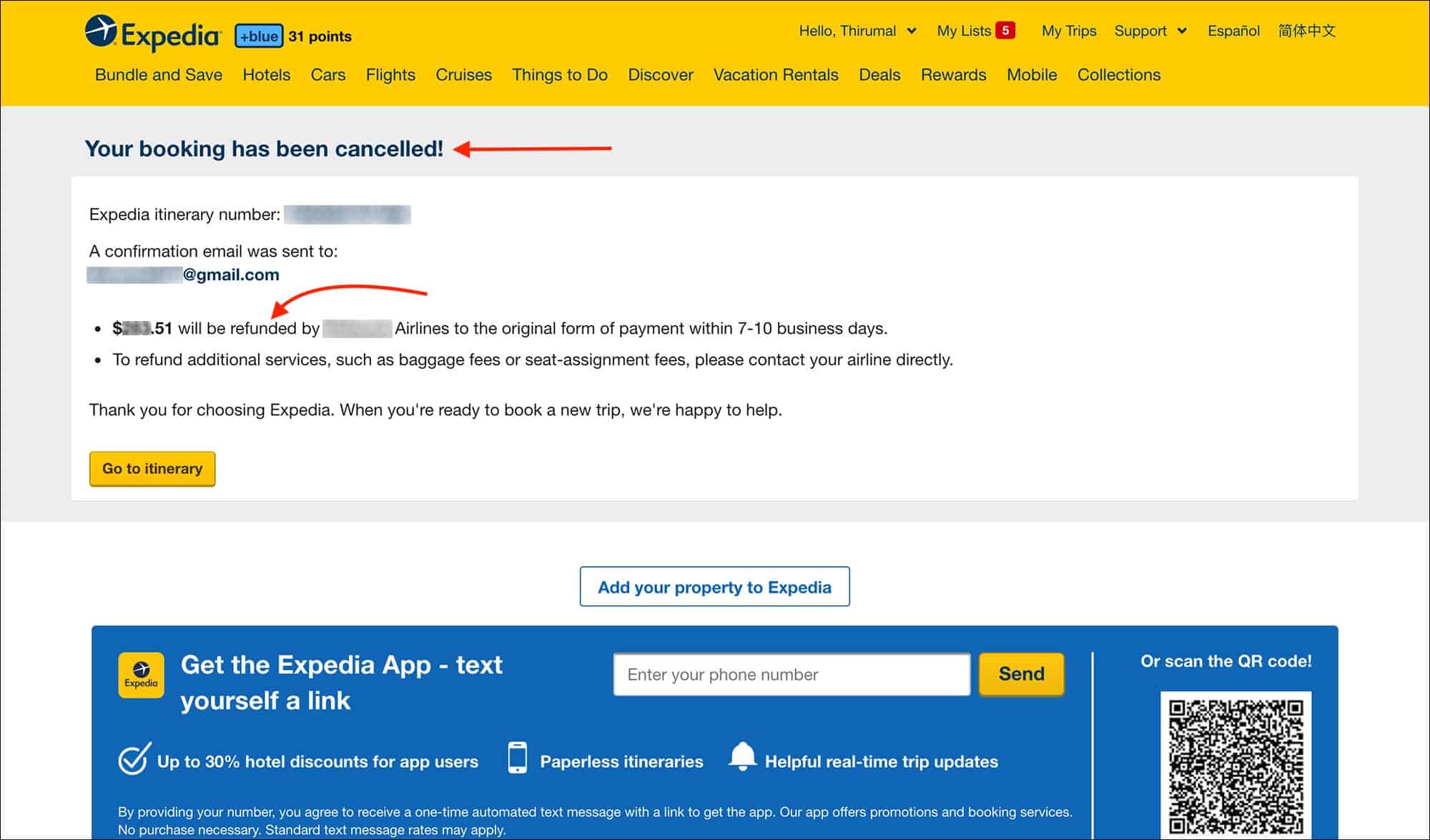

What To Do If You Booked A Trip And Have No Travel Insurance

First, look at when you actually booked the trip. If it was within the last three weeks, you may still be eligible for a comprehensive travel insurance plan with the cancel-for-any-reason add-on. And if not, there may still be more limited policies that provide some coronavirus-related protection including emergency medical evacuation.

In short, its critical to begin investigating your travel insurance options as soon as you book a trip, as this will maximize the number of applicable plans. This is particularly important when it comes to time-sensitive benefits like CFAR protection.

To explore these options, you can enter your trip details to compare available plans on a site like InsureMyTrip.com.

You Have A Longer Coverage Window For Trip Cancellation Benefits

You know you should buy travel insurance with trip cancellation benefits to protect your upcoming culinary tour of southern Italy. Its a big splurge, and youd hate to lose your investment. However, you keep putting it off. Then, a week before you leave, your wife suffers a debilitating back injury when someone rear-ends her car. You need to postpone your trip but its too late to buy trip cancellation benefits.

Can you buy trip cancellation insurance after booking your trip? Absolutely. Trip cancellation protection begins on your plans effective date, as long as we receive your premium before you cancel your trip or make a claim.

So when you purchase trip cancellation insurance, youre protected in case of cancellations due to covered reasons that occur from your effective date until you depart. However, benefits are not retroactive you wont be covered for losses caused by something that has already happened . Thats a good reason to buy trip cancellation insurance as soon as possible.

Also Check: What Is The Cost Of An Alaskan Cruise