Be Prepared For Turbulence

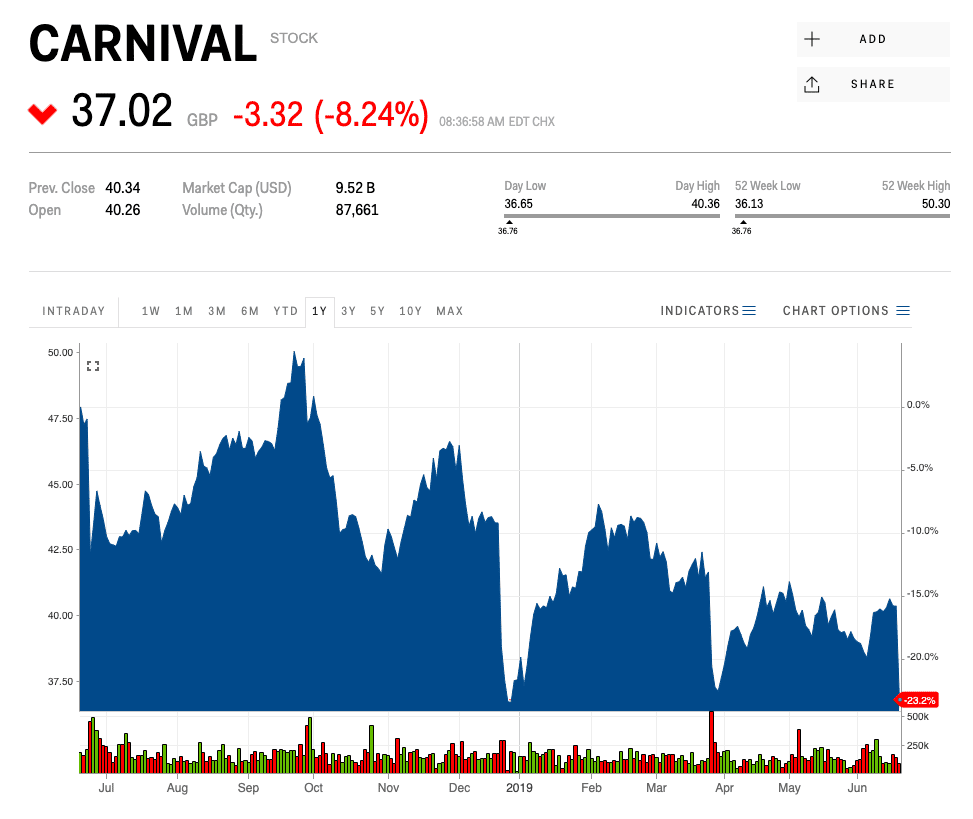

Historically, Carnival cruise stock options have fluctuated pretty regularly. In the long-term, however, these stocks have continued to rise in value, and many cruise stock investors have netted some solid returns.

As with any stock, however, historic trends can still change, and any investment you make is at your own risk. If you can familiarize yourself with the patterns of rising and falling values, you can time your buy-in to be when the stock is at a low point and about to go up again, thus maximizing your Carnival cruise line stock benefits.

Will Carnival Stock Recover

Whether and how soon Carnival stock can recover will depend on how soon its ships can start sailing. Right now, there isnt much good news on that front. Currently, the CDC has a no sail order in place for all cruise ships. Initially issued in March, the order was extended indefinitely in April and prevents the ships from sailing in waters the U.S. has jurisdiction over. In November, CDC conditionally allowed some cruises to operate. How soon the cruises set sail in general, however, will depend on how soon we have a successful vaccine rollout.

There’s some good news on that front. Moderna and Pfizer have come up with vaccine candidates that have shown more than 90 percent effectiveness against COVID-19. According to industry experts, by the summer of 2021, we might be somewhat back to normal with a large part of the population vaccinated. Such a scenario, though optimistic, should bode quite well for cruise lines in general and Carnival in particular.

Is Ccl Stock A Buy Sell Or Hold

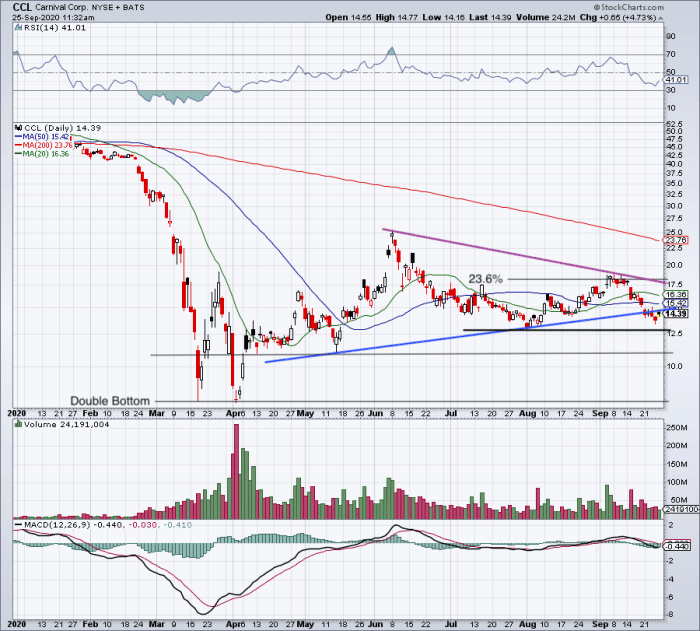

CCL stock is down nearly 50% since February 1, 2020. This makes it seem like a potential multi-bagger as a turnaround play. If the company can capitalize on pent-up demand it could soar. However, there is another side to this. Carnival did not just fund its pandemic operations with debt. They also funded it with equity financing, or, issuing shares.

Since just prior to the pandemic through last quarter, the average shares outstanding has risen 65%. Because of this, the stock is not nearly as discounted as the share price would have one believe. In fact, the market cap is only 16% lower than February 1, 2020. Add in the debt on top of this and the enterprise value is actually 17% higher than it was just prior to the pandemic. These metrics are each graphed below.

Read Also: Portland Spirit Cruises And Events

Royal Caribbean Cruises Stock Forecast

Bulls will focus on the 30-week moving average here, which currently sits just below $52. The $50 level has proven difficult in the past, but bulls now have a leg up with the $56 price target from UBS. The Moving Average Convergence Divergence has been crossed over for awhile now, but it will need to cross above the zero threshold for a continuing rally. Near-term support is at $31, and longer-term support sits at $20 and $24.

RCL weekly chart

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Mid Cap Us Pick List September 2022

This pick list highlights constituents of the Morningstar US Mid Cap Index that we believe offer investors the best risk-adjusted return prospects. The market capitalization range for U.S. mid-caps typically falls between $1 billion and $8 billion and represents 20% of the total capitalization of the U.S. equity market.

Also Check: Cruises Out Of New York August 2022

Consensus Eps Estimates Fall By 25%

The consensus outlook for earnings per share in 2022 has deteriorated. 2022 revenue forecast decreased from US$13.5b to US$12.3b. Losses expected to increase from US$3.74 per share to US$4.70. Hospitality industry in the US expected to see average net income growth of 11% next year. Consensus price target down from US$15.40 to US$12.53. Share price fell 3.8% to US$6.76 over the past week.

Carnival Cruise Lines Stock Forecast

As we said earlier, UBS’ low price target of just $8 places a sort of cap on the CCL share price. From the weekly chart below, it is clear that Carnival stock has dropped below the pandemic low from March 2020 that was around $8. With the UBS suggestion, this is now the focal point for the share price. Below here CCL is bearish above $8 it is bullish. Bulls may focus on the 8-week moving average near $8.80 or even the 30-week average at $12, but it all for naught until the macro picture for equities turns positive.

CCL weekly chart

Don’t Miss: Do Mississippi River Cruises Have Casinos

Technical Assessment: Neutral In The Intermediate

Wednesday was just an average “Fed Day.” Move on folks, there’s nothing to see here! At about 10:18 a.m., the S& P 500 was up 85 points or 2%. Market breadth was very strong and it looked like we might get a very important 80%+ day. The index then flattened out and lost ground, and then actually went negative following the release of the Fed minutes. But in the blink of the eye, the index was back — ultimately finishing 95 points higher. So we got an 80%+ breadth day.

Cunard Announces The New Ship Joining A World

Cunard announced the name of the new ship joining a world-renowned fleet, Queen Anne. Queen Anne will be Cunard’s 249th ship and will make up a remarkable quarter of Queen Mary 2, Queen Victoria and Queen Elizabeth. This will mark the first time since 1999 that Cunard will have four ships at sea. The name “Queen Anne” celebrates Cunard’s rich heritage, royal history and refined status – joining a luxury contemporary fleet now honoring the names of each Queen Regnant over the last millennium. Queen Anne will feature reimagined Cunard signature spaces as well as the introduction of new guest experiences within dining, culture and entertainment, for an unparalleled cruise experience underpinned by outstanding White Star Service. Bridging tradition and contemporary luxury, Queen Anne celebrates the influential design styles of both past and present and introduces an updated Cunard livery. World renowned designers have joined forces to create an extraordinary and thoughtful standard-setting design – inspiring a new way to travel at sea. The décor will reveal bold color tones and showcase a striking aesthetic, while in keeping with the renowned timeless Cunard sophistication.

Read Also: What Cruise Ships Sail Out Of Jacksonville Fl

How To Invest In Carnival Stock

To invest in Carnival stock, like any other stock, youll need to have a trading account. You can choose from a discount or full-service broker. Currently, discount brokers are quite popular. These brokers such as Webull, SoFi Invest, and Squares Cash App allow you to easily and swiftly buy shares of a stock without any commission.

Ccl Stock Analysis Overview

What this means: InvestorsObserver gives Carnival Corp an overall rank of 36, which is below average. Carnival Corp is in the bottom half of stocks based on the fundamental outlook for the stock and an analysis of the stock’s chart. A rank of 36 means that 64% of stocks appear more favorable to our system.

Who this matters to: Overall Ranking is a comprehensive evaluation. It considers technical and fundamental factors and is a good starting point for evaluating a stock.

You May Like: Gulfstream Bt Cruiser For Sale

Carnival Stock Analysis: Historical Quarterly Revenues Per Share For Carnival And Historical Quarterly Revenue Growth:

- Analysts estimate an earnings increase this quarter of$1.12 per share, a decrease next quarter of$0.00 per share, an increase this year of$6.31 per share, and an increase next year of$2.11 per share.

* Carnival stock forecasts short-term for next days and weeks may differ from long term prediction for next month and year based on timeline differences.

This page was last updated on 10/21/2022 by Financhill.com Staff

Disclaimer: Past performance is no guarantee of future performance. This product is for educational purposes only. Practical application of the products herein are at your own risk and Financhill.com, its partners, representatives and employees assume no responsibility or liability for any use or mis-use of the product. Please contact your financial advisor for specific financial advice tailored to your personal circumstances. Any trades shown are hypothetical example and do not represent actual trades. Actual results may differ. Nothing here in constitutes a recommendation respecting the particular security illustrated.

Financhill is not an investment advisor and is not registered with the U.S. Securities and Exchange Commission or the Financial Industry Regulatory Authority. Further, owners, employees, agents or representatives of Financhill are not acting as investment advisors and might not be registered with the U.S. Securities and Exchange Commission or the Financial Industry Regulatory.

Never Miss Another

Why Carnival And Other Cruise Line Stocks Crashed Today

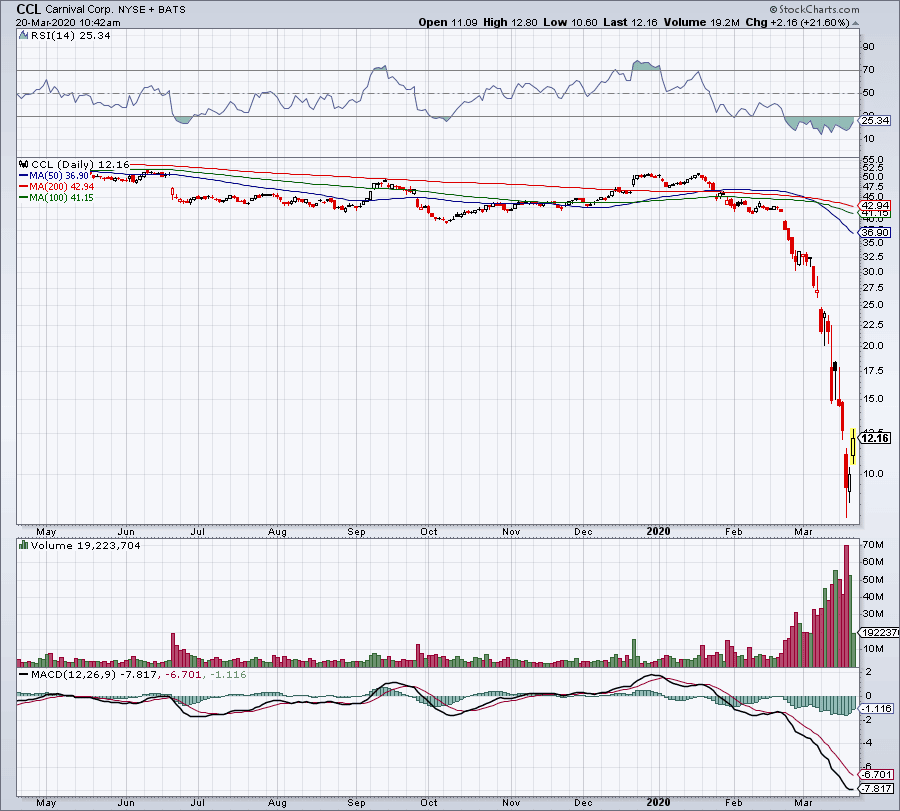

Yesterday I posed the question, “If Carnival misses on earnings tomorrow, what will that mean for Royal Caribbean and Norwegian Cruise Line Holdings?” Well, guess what? Turns out, Carnival Corporation did miss on earnings — badly — and as a result, not just Carnival stock but fellow cruise line stocks Royal Caribbean and Norwegian Cruise Line Holdings , too, are falling hard.

You May Like: What Cruises Depart From Galveston

The Cruise Line Giant’s Occupancy And Revenue Numbers Have Improved Significantly But Is It Enough

Investors in Carnival Cruise Lines have sailed in rough waters for a couple of years now. The COVID-19 contagion shut down its industry for more than a year, and the stock price has remained volatile as investors and analysts go back and forth on whether a full recovery will happen anytime soon.

While its industry struggles, rising occupancies show that passengers want to return to cruising. But is there enough interest from the passengers to get investors interested enough to make Carnival stock a buy?

Price Target Decreased To Us$1885

Down from US$21.53, the current price target is an average from 19 analysts. New target price is 79% above last closing price of US$10.55. Stock is down 60% over the past year. The company is forecast to post a net loss per share of US$3.46 next year compared to a net loss per share of US$8.46 last year.

Also Check: Is Disney Cruise All Inclusive

About The Carnival Corp Stock Forecast

As of 2022 October 22, Saturday current price of CCL stock is 8.200$ and our data indicates that the asset price has been in a downtrend for the past 1 year .

Carnival Corp. stock price has been showing a declining tendency so we believe that similar market segments were not very popular in the given period.

Our site uses a custom algorithm based on Deep Learning that helps our users to decide if CCL could be a good portfolio addition. These predictions take several variables into account such as volume changes, price changes, market cycles, similar stocks.

Future price of the stock is predicted at 30.388093999297$ after a year according to our prediction system.

This means that if you invested $100 now, your current investment may be worth 370.587$ on 2023 October 22, Sunday.

This means that this stock is suited as a new addition to your portfolio as trading bullish markets is always a lot easier.

How To Buy Cruise Line Stocks

While many people choose to hire a stockbroker, there are other services you can use on your own time. One place you can look to start investing is with your current bank or credit union.

Wells Fargo and Capital One are a couple of examples of banks that offer this service. Some online brokerages have a lot of benefits. TD Ameritrade, Fidelity, and E*Trade are all popular options.

Fidelity is a great option if you arent looking to spend an arm and a leg on the investment process. It offers a zero-expense-ratio index and $0 account minimums, which can help you keep more money to invest with. One of our favorite things about Fidelity is that it does not charge for its commissions.

TD Ameritrade also charges $0 per trade and has no account minimum, so it is another good option for beginners. Their products and tools are top-notch, and the research they provide is comprehensive and in-depth.

E*Trade may be a better option if you are a long-time investor and you are looking to branch out. You can trade ETFs and mutual funds for free on this website, but keep in mind that it is geared towards active traders. If you already have accounts on multiple trading platforms, this highly acclaimed brokerage might be a good way for you to expand your portfolio.

Read Also: What Cruise Lines Go To Greenland

Saving Up Money To Invest

Cruise line stocks are not cheap, and if you want to get the most Carnival cruise line stock benefits, youll probably want to buy at least 100 shares. The exact amount to invest varies between cruise lines and what the price happens to be at a given time.

When the COVID-19 pandemic hit in March-April of 2020, cruise line stock prices rock bottom. Even at such low prices, it still would take at least $1,500 to buy a significant amount of stock. In the past, stock prices for carnival cruise lines have ranged from $40 to $60, sometimes fluctuating outside of these averages.

If you buy in at a particularly low-cost time, you can get 100 stocks in Carnival Corp. for less than $2,000. When prices are closer to the average, you may be investing $4,000 to $5,000, and when prices are particularly high, the price of 100 stocks could be over $6,000.

If you are organizing your investment funds, youll probably want to have around $5,000-$8,000 set aside to play around with cruise line stocks. If youre not quite in that financial position, do bear in mind that you can still buy as little as one stockbut less risk means less opportunity for reward.

Norwegian Cruise Line Stock Forecast

NCLH stock closed the session on Wednesday just below the 9 and 21-week moving averages. This region between $13 and $13.40 will be difficult to break through due to those overhanging points of resistance. This makes it likely that Norwegian Cruise Line stock will pull back to form a base before making a new drive higher. Above the moving averages, however, sits the descending top trendline at $16.50. Longer-term support sits in the zone between $10.30 and $11, so there is sparse room for the stock to rotate within this region.

NCLH weekly stock chart

You May Like: What Is The Longest Cruise You Can Take

Price Target Decreased To Us$2101

Down from US$23.03, the current price target is an average from 19 analysts. New target price is 119% above last closing price of US$9.57. Stock is down 66% over the past year. The company is forecast to post a net loss per share of US$2.35 next year compared to a net loss per share of US$8.46 last year.

Carnival Stock In 2022

Before looking ahead, it is important to look at how we got here, and what exactly “here” looks like. It is an odd experience to listen to old podcasts or read articles from March and April 2020. We were looking forward to life as normal by June of 2020.

Carnival Cruise Line announced on April 13 another extension on its voluntary suspension of cruise operations. At the moment, the cruise line plans on resuming cruises in North America on June 27, 2020.

Since then the dates for resumption have seemed to be endlessly extended, followed by limited sailing with heavy restrictions. The CDC has recently extended certain COVID-19 protocols, which were set to expire November 1, 2021, to January 2022. Vaccines and other protocols have finally seemed to turn the tide and CCL is once again bringing in much needed revenue after four straight quarters of revenues below $50M. This for a company used to earning more than $4B in top line revenue each quarter.

The graph below from February 1, 2020 to July 1, 2020 shows how the stock price and revenue dropped off a cliff in late February 2020. Revenues dropped more than 85% during this short period. Truly a once-in-a-lifetime event – or so we hope.

Extending the graph further, it shows that there is a glimmer of hope in the recent revenue results. Still far below optimal, but nonetheless improving. The company generated over $540M in the most recent quarter.

Also Check: Cost Of Disney Cruise For Family Of 4

Nclh Ccl Rcl Stock News

UBS said its decision to upgrade Carnival Cruise Lines was mainly due to better-than-expected booking data. Lots of customers have pent-up demand for cruises after suffering indoors over the past two years due to the Covid-19 pandemic. Now that the pandemic has largely been ignored outside of China, cruise companies are seeing somewhat better demand than they did pre-pandemic.

We are now overweight the cruise sector with a preference for RCL due to its stronger occupancy recovery, record pricing on bookings both in 2H’22 and 2023, and lowest near-term maturities, UBS said in its client note. We see NCLH as our next most preferred name due to relatively greater concentration of domestic passengers sourced and strong pricing given its higher exposure to the luxury segment.

UBS’ upgrade come a few weeks after Truist Securties also upgraded Norwegian to Buy and a price target of $19, and Barclays moved its price target from $14 to $16 on the stock.

UBS also maintained its Buy rating on Carnival Cruise Lines on Wednesday, but it is surprising that CCL stock advanced so thoroughly since the Swiss investment bank cut its price target from $11 to $8. Closing the session at $7.31 on Wednesday gives CCL little room for further advancement, and shares are duly selling off in Thursday’s premarket.