Norwegian Cruise Line Holdings Q2 2022 Earnings Call Transcript

Image source: The Motley Fool. Norwegian Cruise Line Holdings Q2 2022 Earnings CallAug 09, 2022, 10:00 a.m. ETContents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks: OperatorGood morning, and welcome to the Norwegian Cruise Line Holdings business update and second quarter 2022 earnings conference call.

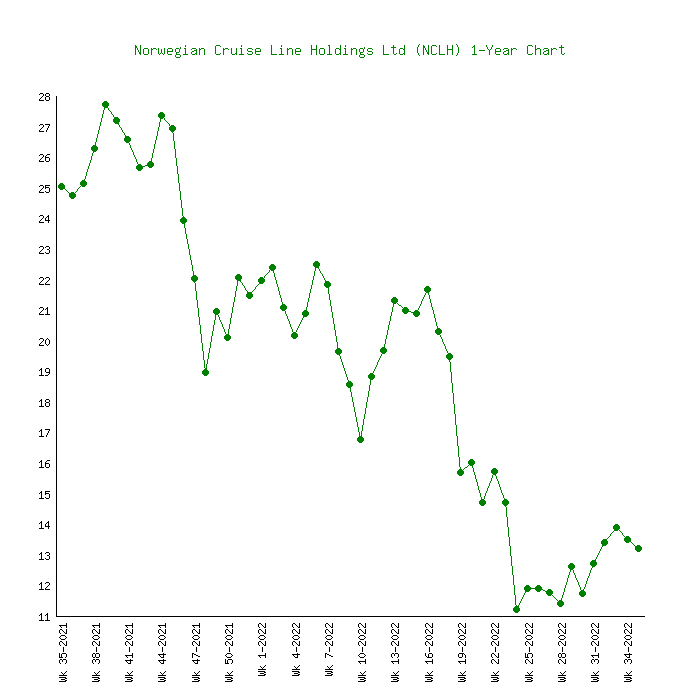

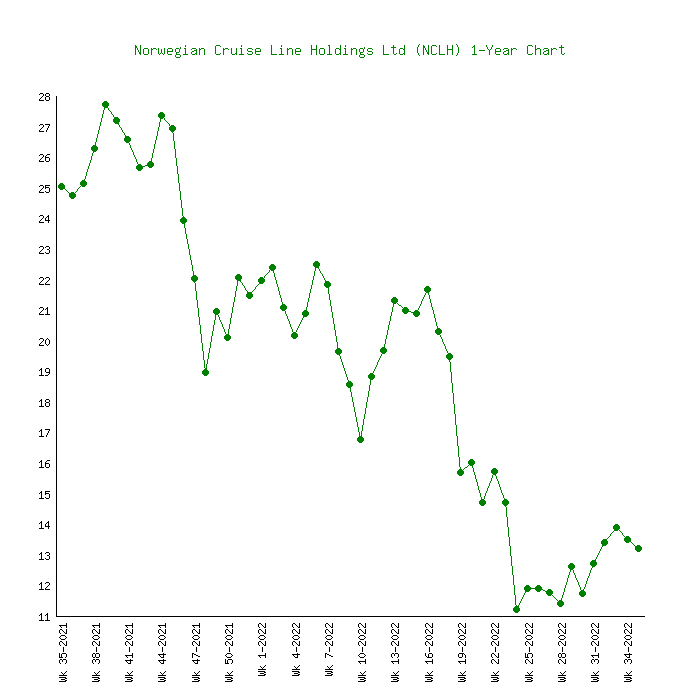

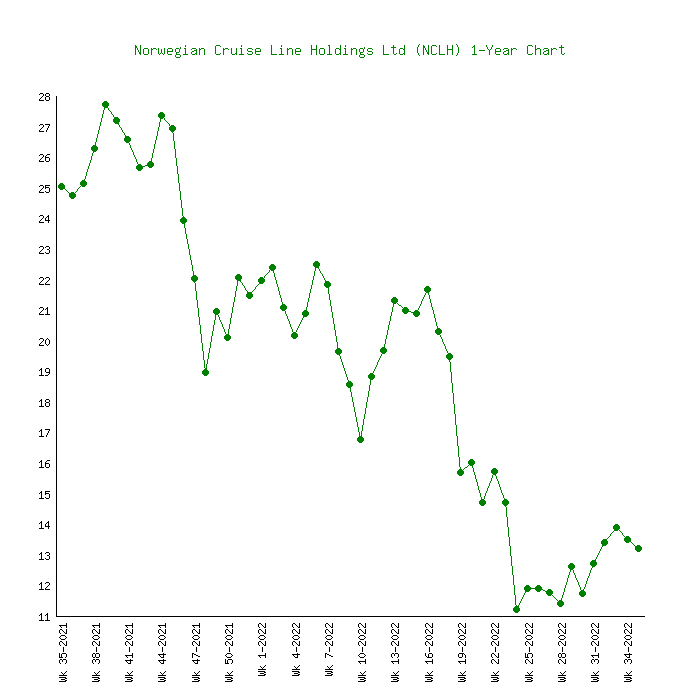

Norwegian Cruise reported disappointing earnings and is trading lower. If it breaks a particular level, new lows could be in store.

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

- Gear advertisements and other marketing efforts towards your interests.

To learn more about how we handle and protect your data, visit our privacy center.

Why Carnival Royal Caribbean And Norwegian Cruise Stocks Popped

As trading starts to wind down for Tuesday, Aug. 16, shares of cruise line stocks are winding back up. As of 3:35 p.m. ET, Norwegian Cruise Line Holdings stock is sporting a 3.2% gain, followed by Royal Caribbean , which is rising 3.7%. Leading the whole pack higher, meanwhile, is industry bellwether Carnival , up 4.6%.

Carnival President Christine Duffy said guests are responding very favorably to the updated protocols.

Also Check: What Is The Best Cruise For Kids

Oceania Cruises Announces 2024

Oceania Cruises, the world’s leading culinary- and destination-focused cruise line, announced its most extensive, expansive, and immersive series of World and Grand Voyages for 2025. The line reprised its perennially popular Around the World in 180 Days voyage for 2025, albeit in a very unique east-to-west navigation. Underscoring the increasing popularity of the brand’s demand for longer, languid, destination-immersive voyages, Oceania Cruises also introduced a series of seven Grand Voyages ran

Norwegian Cruise Line has very quietly done something that will delight many, or even most, of its customers, while it makes a few mad.

Companies in The News Are: INTU, NCLH, JWN, DY

Yahoo Finance’s Jared Blikre looks at what stocks and sectors made the biggest moves in the market on Tuesday afternoon.

The cruise line has done something that may also benefit Royal Caribbean, Carnival, and other cruise lines.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Read Also: Where Is Cruise Port In New York

Norwegian Cruise Line Holdings Ltd Stock Rises Thursday Outperforms Market

rising 0.61% to 31,774.52. This was the stock’s fourth consecutive day of gains. Norwegian Cruise Line Holdings Ltd. closed $15.17 below its 52-week high , which the company reached on November 5th.

The stock underperformed when compared to some of its competitors Thursday, as Royal Caribbean Group RCL, +3.17% rose 2.65% to $10.08. Trading volume eclipsed its 50-day average volume of 19.8 M.

Editor’s Note: This story was auto-generated by Automated Insights, an automation technology provider, using data from Dow Jones and FactSet. See our market data terms of use.

Just in time for the likely depressing final act, celebrity Kim Kardashian enters the private-equity act. With public markets swooning, can private ones be far behind?

Norwegian Cruise Line Holdings Announces Donation Of Waterfront Parcel In Juneau To Alaska Native

Conversion of Parcel to New Pier and Welcome Center will Provide Significant Boost to Local Economy Partnership with Huna Totem Further Strengthens Companys Position in Popular Alaska Cruise Market with Preferential Berthing Rights MIAMI, Aug. 23, 2022 — Norwegian Cruise Line Holdings Ltd. , a leading global cruise company which operates the Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises brands, today announced i

Recommended Reading: What Cruise Line Is All Inclusive

Norwegian Cruise Lags Q2 Earnings & Revenues

Norwegian Cruise reported second-quarter 2022 results, wherein earnings and revenues missed the Zacks Consensus Estimate. However, both the metrics improved year over year.On May 7, 2022, the company completed its phased fleet relaunch, and its entire 28-ship fleet is now operating. In second-quarter 2022, occupancy was 65%, in line with the companys expectations. In the first quarter of 2022, occupancy was 48%. The company expects occupancy to increase sequentially. Occupancy is likely to average in the low 80% range in the third quarter of 2022.

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Also Check: What Cruise Lines Go To Canada New England

Why Cruise Line Stocks Keep Going Down

Cruise stock investors are still sailing into hot water as the summer sailing season approaches its end. For the past four days running, shares of both Carnival Corporation and Royal Caribbean have gone nowhere but down — and even Norwegian Cruise Line Holdings notched only a single “up” day in the series. On Monday, the trend continues, with Carnival stock down 3.9% as of 11:15 a.m. ET, followed by Royal Caribbean with a 3.7% loss, and Norwegian Cruise sliding only 3%.

Today is shaping up negative for Norwegian Cruise Line Holdings Ltd. shareholders, with the analysts…

If debt costs eat up all of cruise companies’ profits, is there any reason to buy cruise stocks?

Expenses & Operating Results

Total cruise operating expenses increased 329.8% in the quarter under review from the year-ago quarters levels. The companys expenses in the quarter primarily stemmed from the resumption of cruise voyages. The company noted that the increase in 2022 reflects an improvement in payroll, fuel, and direct variable costs of fully operating ships.Gross cruise costs in the second quarter increased 222.2% year over year to $1,402.4 million. Adjusted net cruise costs amounted to $838.1 million compared with $349.9 million in the prior-year quarter. Fuel price per metric ton increased to $836 from $673 in 2021.Net interest expenses in the quarter were $144.4 million, up from $137.3 million in the year-ago quarter.

Also Check: Does Aaa Offer Discounts On Cruises

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

These Stocks Soared Up To 12% After Inflation Cooled

DEEP DIVE Amid the euphoria following what appeared to be the first sign of slowing inflation, stocks staged a broad rally on Aug. 10, with dozens of large-cap stocks rising 5% or more. Those included several tech names that investors loved during the early stages of the coronvirus pandemic, along with cruise lines, credit-card lenders and chip-related companies.

Norwegian, the first cruise line to drop mandatory covid vaccinations for U.S. sailings, sees calmer waters ahead.

Don’t Miss: Where To Park At Port Canaveral For Cruise

People Are Still Going To Travel: 10 Travel Stocks To Buy Despite Recession Fears

In this article, we discuss the 10 travel stocks to buy despite recession fears. If you want to skip our discussion on the travel industry outlook, go directly to 5 Travel Stocks to Buy Despite Recession Fears. In an interview with CNBC on August 4, Jed Kelly at Oppenheimer presented his bullish outlook on travel

Today’s shocking news: Just like Carnival and Royal Caribbean, Norwegian Cruise Line Holdings will lose money in Q3.

Yahoo Finance Live examines Norwegian Cruise’s stock as it announces pre-pandemic occupancy goals for 2023.

Earnings & Revenue Discussion

Norwegian Cruise reported an adjusted loss per share of $1.14, wider than the Zacks Consensus Estimate of a loss of 82 cents. In the prior-year quarter, the company reported a loss per share of $1.93.Quarterly revenues of $1,187.2 million lagged the consensus mark of $1,264 million. In the prior-year quarter, the company had reported revenues of $4.4 million. The upside can primarily be attributed to the resumption of cruise operations. In the quarter under review, passenger ticket revenues were $793.9 million compared with $1.5 million reported in the prior-year quarter. Onboard and other revenues increased to $393.3 million from $2.8 million reported in the prior-year quarter.

Also Check: Is Celebrity Cruises Kid Friendly

Why Is Norwegian Cruise Line Up 35% Since Last Earnings Report

Zacks Equity Research

You follow Realtime BLOG – edit

You follow Zacks Equity Research – edit

What would you like to follow?

Zacks Equity Research

A month has gone by since the last earnings report for Norwegian Cruise Line . Shares have added about 3.5% in that time frame, outperforming the S& P 500.

Will the recent positive trend continue leading up to its next earnings release, or is Norwegian Cruise Line due for a pullback? Before we dive into how investors and analysts have reacted as of late, let’s take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Norwegian Cruise Lines Stock Is A Buy Analyst Says Booking Trends Look Strong

Norwegian has shared a boat load of bad news recently, but a Stifel analyst says its time to buy the cruise liners stock given the strength in booking and pricing patterns.

Norwegian Cruise Line Holdings stock has slumped 4% since its earnings report on Aug. 9. Its latest quarterly revenue missed estimates, and the company said it would continue to be unprofitable in the third quarter.

Recommended Reading: What Cruise Lines Leave From Cape Liberty Nj

Norwegian Cruise Line Holdings Has Yet To Take Advantage Of Positive Externalities

Over the last few years, Cruise operators like Norwegian Cruise Line Holdings Ltd. could hardly catch a break as the world seemingly went from one crisis into another. With the travel sector recovering, the ongoing military conflict and problematic macroeconomic conditions resulted in yet another negative quarter. While the stock rose on the news, this is likely more a result of external factors.

Guidance & Booking Updates

Due to the coronavirus pandemic and the Russia-Ukraine conflict, the company is unable to estimate the impact on its business. The company expects to report a net loss for third-quarter 2022. In third-quarter 2022, it anticipates net interest expenses to be nearly $160 million. For the full year, it expects the same to be $615 million, excluding losses on extinguishment of debt. Depreciation and amortization are forecast to be roughly $190 million for the third quarter of 2022 and $745 million for the full year of 2022.The company expects occupancy to be in the low 80% range in the third quarter of 2022. Capacity days are anticipated to be 5 million in the third quarter and 5.1 million in the fourth quarter. In the third quarter, the company expects revenues to be in the range of $1.5-$1.6 billion. Adjusted net cruise cost is likely to decline by nearly 10% in the second half of 2022 compared to the first half of 2022.The cumulative booked position for the second half of 2022 continues to be below the comparable 2019 period. However, booking trends for 2023 remain in line with a record of 2019.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates have trended downward during the past month.

The consensus estimate has shifted -235.34% due to these changes.

VGM Scores

Overall, the stock has an aggregate VGM Score of D. If you aren’t focused on one strategy, this score is the one you should be interested in.

Outlook

Don’t Miss: Where Do Cruise Ships Dock In Aruba

Norwegian Cruise Line Donates Juneau Waterfront Parcel For New Pier Development

Norwegian Cruise Line Holdings Ltd is donating its undeveloped waterfront property in Juneau, Alaska, to the native-owned Huna Totem Corporation. Huna Totem is a long-standing partner and a local leader in Alaska’s tourism development. Huna Totem will develop a new pier and related infrastructure on the parcel and submit plans for the year-round facility before 2022-end. Norwegian Cruise Line will receive preferential berthing rights at the pier once development is complete. The fut

What Is The Market Capitalization Of Norwegian Cruise Line Holdings

Capitalization is the market value of Norwegian Cruise Line Holdings is calculated as the number of issued stocks multiplied on the current quotation price. Thus, on 10.09.2022, the market capitalization of Norwegian Cruise Line Holdings is estimated at about 6118967018 dollars.

Finrange is a stock analysis service for private investors. We create tools for investing that help to earn money in stock market spending less time for it.

Don’t Miss: What Cruise Lines Depart From Houston

Cruise Stocks To Buy On The Dip

When U.S. investors think about cruise stocks to buy on the dip, they usually think of the three main companies: Carnival , Royal Caribbean Cruises , and Norwegian Cruise Line . However, there are several cruise-related businesses that also make potentially attractive stock picks at this point in the market. Its not just as simple as picking one of the three biggest players. Furthermore, it makes far more sense to spread your bets amongst several companies that ea

What Happened

Tuesday was supposed to be a good day for cruise stock investors — but that’s not how it’s working out anymore.

In early trading, shares of Royal Caribbean climbed as much as 4.3%, while Carnival and Norwegian Cruise Line Holdings notched gains as high as 5%.

Norwegian itself seems to have been the catalyst for the share price spikes, powering ahead on the strength of positive comments from the company’s president, Harry Sommer. But confusing reports on the jobs front appear to be making investors jittery, and as we approach the noonday mark, stocks of Royal Caribbean, Carnival, and Norwegian are all now in the red.

Read Also: Which Is Best Cruise Line