Carnival Corp Plunges On Forecast Of Q4 Loss Delayed Return To Profitability

Carnival Corp on Friday forecast a loss in the fourth quarter after it reported results for the third quarter that fell well short of Wall Street estimates, as higher fuel prices and cheaper fares offset a rise in bookings. Shares of Carnival plunged 20% to $7.33 per share in midday trading, falling to nearly a 30-year low. High inflation has further hit cruise operators that have been running at a loss since the COVID-19 pandemic took hold in 2020 for an array of reasons including lockdowns, bans on cruises, safety issues and labor shortages.

Carnival Cruise Stock Down Significantly What Happened

Carnival stock is plunging to almost $11.00, the lowest since April 2020. Could there be a rough time ahead for the cruise company?

Trading at $71.65 before the pandemic and down to $11.23 at the time of writing, Carnival Corporation seems to be a company that cannot catch a break. The stock took several hits this week as investment companies took a bearish take on the stock.

While investors seem to be confident that the travel industry will be recovering in the coming months and years, the take on Carnival Corporation appears to be taking a more negative turn.

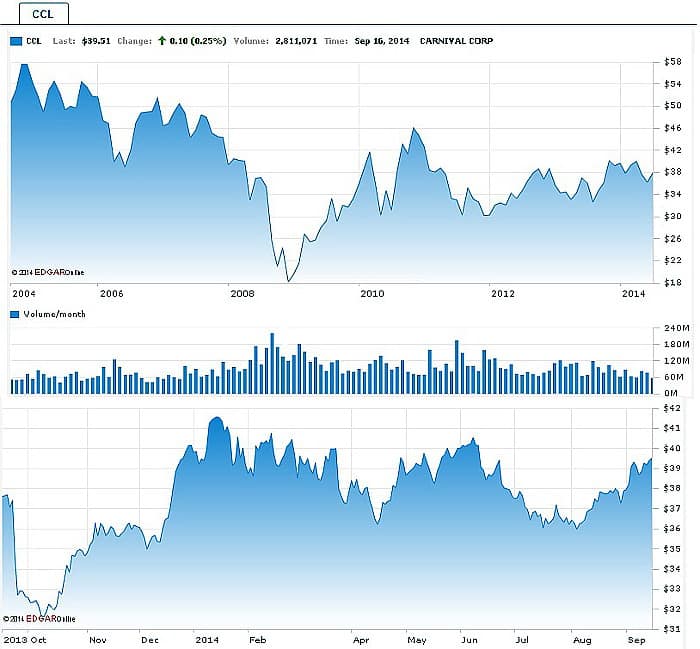

A Closer Look At Ccl Stock

Depending on how ambitious and optimistic we are, its possible to set a couple of different price objectives for CCL stock.

- 7 Cheap Stocks to Buy If You Have $250 to Spend

The most obvious one would be $50, the share price that it had reached in mid-January of 2020. Those were good times, werent they?

At the end of May 2021, it felt like CCL stock would reach that target soon as it hovered near $30.

Then investors started to worry about new Covid-19 variants. As a result, a bull market in Carnivals shares was off the table.

Yesterday CCL stock closed slightly above $23. That, of course, isnt even halfway to the $50 level.

But then, is that necessarily a bad thing? Maybe its an opportunity for investors to add shares now, in the hopes of doubling their money.

Possibly, they could even do better than that. After all, CCL stock was riding high at $70 in early 2018. It might get there again. That wont happen tomorrow or next week, but it will occur eventually.

Read Also: Keeping The Blues Alive Cruise 2022

Also Check: Where Does Celebrity Cruises Go

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Tokenised Carnival Stock Trading Guide

Trading tokenised Carnival shares is no more difficult than regular stock. To begin trading you will follow need to follow a few simple steps:

- Register for an account with Currency.com.

- Deposit funds in the account.

- Determine the position size desired, accounting for leverage offered by Currency.com.

- Determine your trading position based on expected share price movement and purchase tokenised Carnival shares derivatives. Currency.com matches the long orders from its clients with the sell orders and then hedges the unmatched orders through Capital.com, LMAX Digital or exchanges such as Binance, Bitstamp, Kraken, NASDAQ, NYSE and Gain Capital.

- Close your position when applicable. You can set a take-profit or stop-loss indicator to ensure you are not required to constantly monitor the price. Funds will deposit back to your account after closing and you can withdraw or take a new position.

Read Also: What Is The Newest Ship For Norwegian Cruise Line

Who Are The Key People At Carnival

Arnold W. Donald has been President and Chief Executive Officer of Carnival Corporation since 2013. Before that, he worked for many years at Monsanto. Donald is credited with turning round Carnivals reputation and market value after the Costa Concordia disaster of 2012. He launched reviews of Carnivals culture and operations, and pushed forward a modernisation agenda.

Other senior executives to watch include Chief Financial Officer David Bernstein and Chief Strategy Officer Josh Leibowitz. Micky Arison has been Chairman of the Board of Directors of Carnival Corporation since 1990. He was Donalds predecessor as CEO and son of the companys co-founder.

Why These 10 Stocks Are Trending Today

In this article, we will take a look at 10 stocks that are trending today. If you want to see some more stocks that made their way into the headlines today, go directly to Why These 5 Stocks Are Trending Today. After a substantial sell-off on Thursday, the markets are relatively quiet today with the

Don’t Miss: What Cruises Leave From Boston

Holland America Line Partners With The Statue Of Liberty

Holland America Line will partner with The Statue of Liberty-Ellis Island Foundation, the 501c3 non-profit organization dedicated to preserving the eponymous landmarks, to celebrate the cruise line’s 150-year journey from immigrant carrier to consumer ocean liner fleet. The partnership, which kicks off October 26 as Holland America Line completes the recreation of the brand’s first-ever sailing from Rotterdam to New York City, features on-board video content across Holland America’s entire fleet

Stock Market News Live Updates: Stocks Surge As Wall Street Crawls Out Of A Brutal September

U.S. stocks kicked October off on a strong note Monday after the S& P 500 and Nasdaq Composite closed out their first three-quarter losing streak since the 2008 Global Financial Crisis and the Dow logged its first such span of losses since 2015.

The benchmark S& P 500 index soared 2.6%, while the Dow Jones Industrial Average jumped roughly 765 points, or around 2.7%, notching its best day in more than two months. The technology-heavy Nasdaq Composite advanced 2.3%.

Sizable moves in energy markets kicked off the week, with oil prices swinging higher as reports surfaced that OPEC+ is considering a big production cut of more than one billion barrels per day. West Texas Intermediate crude oil surged and settled above $83 per barrel.

Also, in the U.K., sterling edged higher after Prime Minister Liz Truss U-turned on a tax-cut plan that had spurred market tumult and an intervention from the Bank of England last week.

On the corporate front, shares of Credit Suisse pared losses from an earlier drop, closing up 2.3%. Over the weekend, the global investment banks CEO issued a memo attempting to calm major investors about the institutions financial health an effort that backfired and instead raised questions about the banks stability.

A high-stakes earnings season likely to be wrought by slashed forecasts and worsening fundamentals tied to inflation and rising interest rates, however, makes this time different.

Don’t Miss: Cheapest Time To Cruise Caribbean

How To Invest In Carnival Stock

CCL trading occurs on the New York and London Stock Exchanges. Carnival is also the only company in the world that is a constituent of both the S& P 500 and the FTSE 250 representing the largest companies traded on both exchanges. Traditionally, those looking to invest in Carnival stock would purchase shares or an index which includes CCL. Traders are also able to purchase derivatives based on CCL stock such as contracts for difference or options.

Traders using the Currency.com tokenised trading platform are able to profit from upward or downward movements in the Carnival share price without having to invest directly. Tokens are crypto derivatives whose value is linked to the value of a particular asset, in this case the CCL price today. The token is registered using distributed ledger technology the same way cryptocurrency is recorded. This technology allows for trading using crypto without the need to convert back and forth with fiat currency, saving on exchange fees. The utilisation of this technology allows trading to be efficient, inexpensive and secure.

When trading tokenised stocks you can take a long or short position depending on whether you feel the price today is over or under-valued based on the price chart. If you think the price will decrease you can short the tokenised stock if you think it will increase you can take a long position. Trading on Currency.com also allows traders to benefit from the leverage offered on the platform, up to 1:100.

Down 83% Since January 2018

While CEO Arnold Donald has been receiving commendations for steering the worlds largest cruise company through the pandemic, its not hard to see why the board decided to give Josh Weinstein a chance.

Carnivals stock is currently trading at the lowest point since it crashed in January 2020 and reached its lowest point of $8.49 on April 3, 2020. And this is where the real worry lies.

Carnival Corporations fleet of cruise ships, sailing for nine different brands, are nearly all sailing again. The company has invested heavily in renewing its fleet, increasing efficiencies, and focusing on environmental compliance. Yet it seems to be having little effect.

Read Also: 10 Carnival Cruise Line Stock Benefits and Tips

Selling Seabourn, although still unconfirmed, will bring some breathing space for Carnival Corporation. But it will not satisfy investors. If anything, it will make them even more pessimistic on what the future brings for the cruise giant.

Last week, Bloomberg warned about the rising cost of debt and questioned Carnivals ability to meet its interest payments. That message made Carnivals stock tumble 18.63% this week, 21.49% this month, and 83% since January 2018.

On Wednesday, Morgan Stanley issued another warning on Carnivals debt load, citing weak sales, growing economic risks, and the rising cost of interest on the debt. All in all, the pandemic has turned Carnival Corporation into one that is likely to see some very difficult times ahead.

Read Also: What Cruise Lines Are All Inclusive

Be Prepared For Turbulence

Historically, Carnival cruise stock options have fluctuated pretty regularly. In the long-term, however, these stocks have continued to rise in value, and many cruise stock investors have netted some solid returns.

As with any stock, however, historic trends can still change, and any investment you make is at your own risk. If you can familiarize yourself with the patterns of rising and falling values, you can time your buy-in to be when the stock is at a low point and about to go up again, thus maximizing your Carnival cruise line stock benefits.

Understanding Carnival Cruise Line Stock Metrics

If you invest in Carnival cruise line stocks, you will receive reports from the company on some different metrics. Understanding these in advance can help you to play your investments smarter.

The first thing to keep your eye on is a dividend, which is issued in a percentage. Suppose the cruise line you own a share in pays out an annual dividend yield of five percent. That means that for every $100 stock you own, you will get five dollars per year back.

These come in the form of cash payments, so you can choose to put them in your pocket or reinvest. We talked above about watching bookings. One way to keep track of this is with the metric known as booking volume. This is simply the number of tickets ordered in a given period.

Also Read: 11 Benefits of Using Wholesale Cruise Prices from Club 1 Hotels

The last metric to keep track of is the fiscal year. This is important because it is issued in quarters but may have different start and end dates from the actual calendar year. Be aware of the start and end dates for the quarters in Carnivals fiscal year so you can time your stock movements more effectively.

Disclaimer: Please know that this article is for informational purposes only and readers should get professional advice before making any decisions on stocks.

You May Like: Cost Of Virgin Voyages Cruise

Princess Cruises Ready To Welcome All Guests With Transport Canadas Removal Of All Covid

With todays announcement from Transport Canada to remove all COVID-19 requirements to enter the country, Princess Cruises is prepared to welcome all guests on cruises visiting, arriving or departing from Canadian ports, including its Canada/New England voyages and Alaska cruises where the cruise line is the industry leader. All of Princess Alaska cruises feature Canada as part of the itinerary.

Carnivals third-quarter fiscal 2022 results are likely to reflect benefits from the resumption of operations and encouraging bookings.

Dow Jones Leaders: Apple Microsoft

Among Dow Jones stocks, Apple shares climbed 3.1% Monday, snapping a three-day losing streak. Still, shares are more than 20% off their 52-week high and below their 50- and 200-day lines.

Microsoft rose 3.3% Monday, rebounding from Fridays 52-week low price. The software giant remains more than 30% off its 52-week high.

Be sure to follow Scott Lehtonen on Twitter at @IBD_SLehtonen for more on growth stocks and the Dow Jones Industrial Average.

YOU MAY ALSO LIKE:

Recommended Reading: Who Has The Best Alaska Cruise

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Carnival Drops Exemption Request For Unvaccinated Guests Eases Testing Requirements

Carnival on Friday forecast a loss for the fourth quarter as higher fuel prices and rising costs of everyday essentials delay its return to profitability, sending the cruise operators shares down 19% in midday trading.

Adding to its challenges, Carnival has been heavily discounting and ramping up advertisements to attract passengers after a long pandemic-led interval.

It also has a higher exposure to the mass-market category that has been more affected by inflation. The company said it expects break even to slightly negative adjusted earnings before interest, taxes, depreciation and amortization for the fourth quarter ending Nov. 30.

Web travel and leisure analyst Jim Corridore said the downward revision to the fourth quarter is not related to demand or revenue but to rising costs to restart operations, supply chain issues and likely higher labor, food and fuel costs.

The cruise operators cumulative advance bookings for the current quarter are below the historical range and at lower prices. Earlier this year, Carnival forecast a loss for the year as Moscows invasion of Ukraine added further challenges.

The cruise operators revenue in the third quarter ended Aug. 31 rose to $4.31 billion from $546 million a year earlier, but missed analysts average estimate of $4.90 billion, according to IBES data from Refinitiv.

Net loss, however, narrowed to $770 million, or 65 cents per share, from $2.84 billion, or $2.50 per share, a year earlier.

Don’t Miss: What Drinks Are Free On Celebrity Cruises

Cruise Line Stocks Slide After Carnival’s Booking Update Leads To Waves Of Worry

Carnival Corporation & plc RCLNCLHClark Schultz

Emilian Danaila/iStock Editorial via Getty Images

Cruise line stocks saw some pretty choppy trading on Friday morning after Carnival’s earnings report and update on bookings rattled investors.

Carnival missed EPS and EBITDA estimates with its report and the update on advance bookings for Q4 fell below the historical normal range, which was unexpected just a few weeks ago. The cumulative advance bookings for the quarter were also noted to be at lower prices.

Cumulative advance bookings for full year 2023 were reported by Carnival to be slightly above the historical average and at considerably higher prices, as compared to 2019 sailings, normalized for future credits.

Read more about Carnival’s earnings report.

Recommended For You

How To Buy Carnival Stock With A Brokerage Account

Carnival is a publicly traded company, so its easy to buy through most types of brokerage accounts. If youre of age and you dont yet have a brokerage account, you can open one through a variety of different investment companies and platforms. Before you make a decision on what kind of brokerage account to open, its important to weigh your options. Each broker offers different account minimums and trading commissions, so some accounts will fit your financial situation better than others.

In the grand scheme of the market, CCL stock is fairly reasonably priced. But if youd like to buy a fractional share, you have the option to do so with a brokerage account that supports fractional shares.

Once youve made a decision about what kind of brokerage account to open, you should fund your account and figure out how many shares you want to buy. You can then put in an order to buy shares of CCL. You can buy at market price, or place a limit order that lets you dictate the maximum or minimum price at which youre willing to buy or sell.

| Brokerage Comparison |

Read Also: How Much Does An Alaska Cruise Cost

Also Check: Best Cruise Line For Food

Tasi Slips For A Second Day In Line With Oil Prices: Closing Bell

RIYADH: Saudi Arabias benchmark index ended lower for a second consecutive day after oil prices fell and inflation and high interest rates triggered a global recession.

Brent crude settled at $101.68 a barrel, while West Texas Intermediate traded at $95.83, as of 3:08 p.m. Saudi time.

As of Wednesdays closing bell, TASI lost 0.15 percent to 12,291 while the parallel market, Nomu, added 0.98 percent to 21,758.

The Saudi National Bank shed 0.28 percent, while the Kingdoms largest valued bank, Al Rajhi, fell 0.91 percent.

Saudi British Bank added 0.72 percent, after its profit increased by 10 percent to SR2.1 billion in the first half of 2022.

Herfy Food Services Co. slipped 4.01 percent, after its half-year profit was down 7 percent to SR49 million.

Telecom giant stc gained 0.40 percent, after posting a slight profit surge of 2 percent to SR5.9 billion in the first half of 2022.